Imagine this; you have 1,000 debtors to reach out to before the end of the week and remind them about paying their dues. You have 10 agents ready to call these debtors. Which do you think would be faster and more likely to help you connect with each debtor:

- A manual calling system that requires you to dial each 10-digit number and wait for the person to answer? Or

- An automated system that dials numbers in the backend and automatically connects answered calls to any agent who is free?

Naturally, the latter eliminates a lot of waiting time and will hence be faster and allow your agents to cover more ground.

Automation is efficient, and there’s no doubt that it improves the debt collection process too.

But where do you start? Well, debt collection has traditionally been a call-and-respond industry, so if there’s anything that you should start with, this is the lowest hanging fruit to go after.

In this post, we’ll cover everything you need to know about making automated debt collection calls, starting from the benefits.

Let’s dive in.

Benefits of automated debt collection calls

If you’re not convinced that automation can make debt collection more efficient, here are some benefits of automated debt collection calls that will change your mind.

1. Call scheduling

With an automated service, you will be able to set the time period during which your callers can make calls. No call will be initiated outside of these hours.

How does that help?

Well, you have to maintain TCPA compliance for debt collection calls. As per the regulations, you can’t make calls outside certain hours, and these hours vary from state to state.

Rather than having your callers check their watches before every call (and sometimes even converting the time to the time zone they are placing the call to), setting the campaign hours is just more efficient.

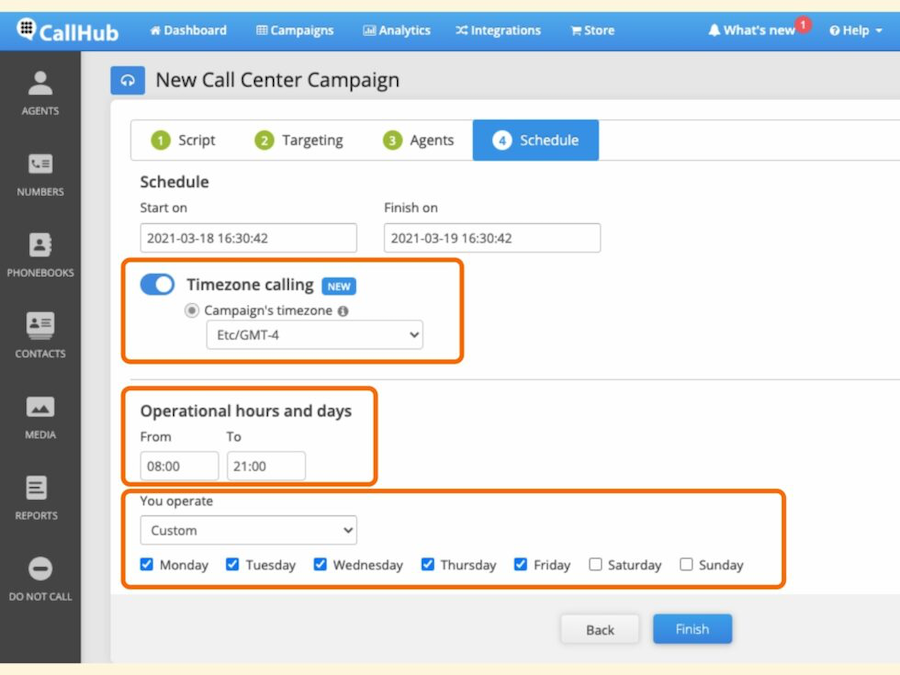

In CallHub, you set the daily operational hours and the time zone that you’re placing calls to schedule in the final step of your campaign setup.

2. Employee productivity

Automating the calling process doesn’t just help you stay compliant in your calling outreach; it also increases employee productivity.

How?

With a tool, you have auto-dialers that let you control the speed of calling based on the type of conversations you’re having.

For example, CallHub’s predictive dialer automatically dials through lists and skips through busy numbers, unanswered calls, and even answering machines. It only connects answered calls to agents who are free, so they spend more time talking to debtors and than waiting for people to pick up. Naturally, this helps them cover more people in a day than usual.

3. Customer service

Unlike mainstream belief, debt collectors are not thugs that break down doors to take what they are owed. They are professionals who need to handle people (debtors) carefully, following the regulations set by the Fair Debt Collection Practices Act. Not complying with these practices is grounds for a lawsuit.

Hence, customer service in the debt collection industry is just as essential as any other business, and automation can improve it.

How?

With an automated calling system, your callers will be more equipped with resources like a debt collection calling script, debtor data, and history, interaction history, etc. These resources help make their interactions more informed and to the point.

For example, if callers know that the debtor was reminded to make the payment multiple times earlier and didn’t do it yet, another reminder may not work. They will have to move the interaction to gauge the ability of the debtor to pay back the debt and possibly negotiate a restructured payment plan, in-kind payment options (if possible), or a lower settlement amount.

4. Reports and analysis

An automated debt collection calling software can provide you with a lot of data and insights that you can use to make better business decisions.

How?

An automated system will produce comprehensive reports of your calling campaigns with metrics like the total number of calls made, calls picked up, an hourly breakdown of calls being answered, etc.

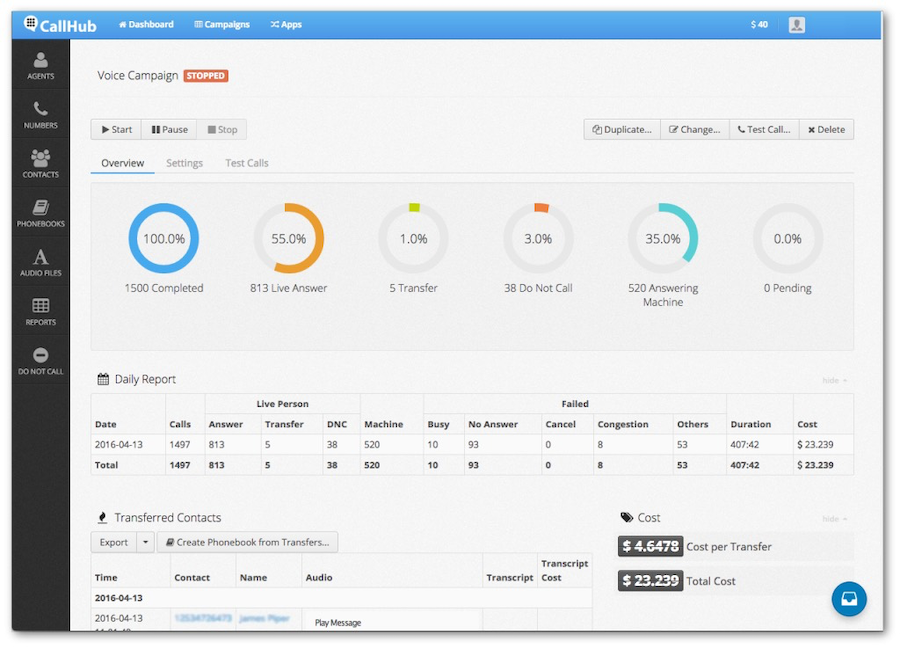

You can analyze these reports to understand what’s working and what’s not. Take this example of a calling report on CallHub:

As you see, a huge number of calls were sent to answering machines, and probably a lot of callers may have had to waste their time leaving them a message.

In this case, opting for a solution with an answering machine detection feature (that would automatically leave a message or skip these calls) would be worth looking into. This would save more of your callers’ time, who could then use it for other critical tasks.

Are debt collectors allowed to use robocalls or automated dialers?

While I was talking about the benefits of automated debt collection calls, I’m sure this question popped in your head. It’s important to have complete clarity on this question to avoid getting caught in a lawsuit.

Debt collectors can use robocalls or automated dialers only if they have the receiver’s consent.

While you can still make automated collection calls to landline numbers without consent, it’s imperative for cell phones. However, a safe option would be to ensure you have consent for both.

You can get this consent from the receiver when they’re applying for a loan, or you can send them an email later requesting consent.

However, make sure that you maintain a Do Not Call (DNC) list of your own because if they revoke their consent later (even after giving it to you initially), you legally cannot leverage robocalls or use automated dialers to contact them.

What do you need to make automated debt collection calls?

Hopefully, you’re convinced by now that automated debt collection calls are something that can improve your business. Because they can, and we’re going to see how you can implement them. Here’s what you need to get started.

- CRM

- Call center software

- Debt collection calling script

- TCPA and FDCPA compliance checklist

Let’s look at each in detail.

1. CRM

A CRM (Customer Relationship Management software) is an essential tool for any business/organization, including debt collectors.

Apart from being the central depository for all your data, a CRM comes handy in many different ways:

- It facilitates workflow automation by allowing you to create a series of tasks based on certain triggers. For instance, you could set a specific trigger for accounts that are past the due date to initiate a reminder sent out to agents to follow-up with the debtor.

- You can segment your list of debtors based on various parameters like debt brackets, repayment history, amount due, repayment ability, etc., to personalize your outreach. For example, for those with poor repayment ability, you will need to negotiate a lower repayment bracket.

- A CRM also integrates with other third-party apps to help you streamline your tasks. For example, your CRM may integrate with your payment gateway and automatically update the transaction details of a debtor who paid their due on time without receiving any reminder.

If you don’t already have a CRM, you can look into LeadsSquared and CRMDialer for options.

2. Call center software

The next thing you need to automate your debt collection calls is a comprehensive cloud contact center tool.

With a calling tool, a lot of your processes become much more efficient. Here are a few examples.

- It integrates with your CRM making it easy for you to import data on the debtor and view it on your calling dashboard. You can then use this data to inform your conversation, just like in the example I spoke about above.

- A calling tool makes it easy for you to take notes during a conversation. This could be anything that you feel may be important to increase your chances of recovering the debt. Since your software is in sync with your CRM, this updated data will reflect in your CRM too.

- With a calling tool, your conversations go more smoothly as it displays the calling script for callers to follow.

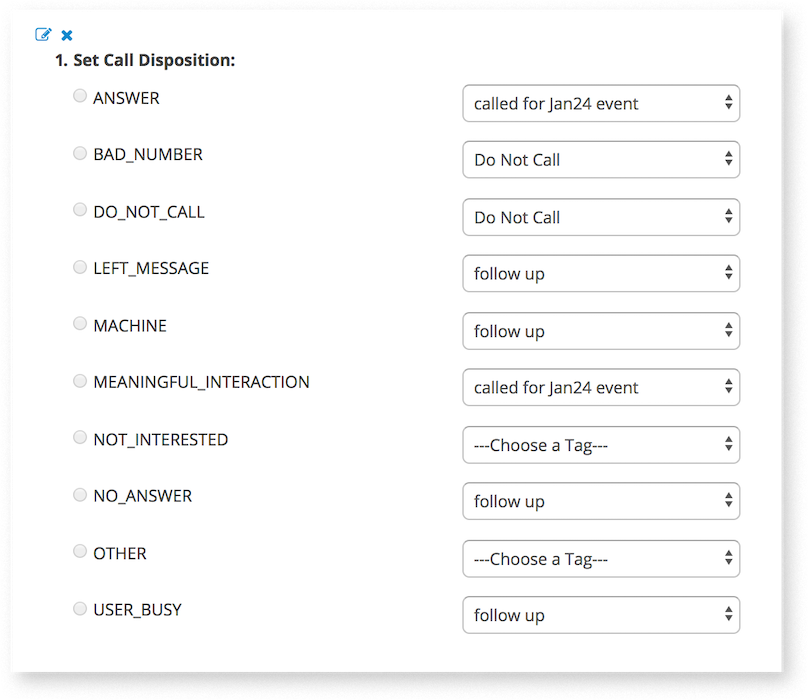

- Cloud contact software typically lets you set call dispositions like no answer, call back, wrong number, etc., for each call. These dispositions help you easily manage your follow-up tasks and your contact list.

Here’s an example of a few call dispositions being used on CallHub.

Read Next: The Most Essential Tools Your Collection Call Centers Need To Improve Debt Recovery

3. Debt collection calling script

For anyone making automated debt collection calls, a calling script is a godsend. Whether you are an experienced caller or a fresher, a calling script comes in handy in the following ways:

- It helps you ensure you don’t miss out on key details during the conversation. It’s hard to keep these details in mind during a call, but with a call script, you don’t have to. It’s right in front of you.

- A script ensures that your callers are following all the FDCPA regulations. Again, this is something that may slip off a caller’s mind without a script. For instance, callers introducing themselves and stating the purpose of the call at the very beginning of the call.

- It helps you overcome common excuses. You can include answers and negotiation techniques for common excuses that you may have come across previously. Since callers will have a good idea of what to say to get the debtor to turn around, this could increase your success rate per call.

4. TCPA and FDCPA compliance checklist

Not complying with the TCPA and FDCPA regulations can get you into serious trouble. Most of the time, debt collectors end up in lawsuits and paying settlements costing more than the debt they were owed.

With a checklist, you can at least avoid that to a large extent. Here’s how:

- Keep the checklist publicly available for callers and agents to refer to it regularly. This way, they could monitor themselves to some extent by understanding if they are not complying with any rule.

- Update the checklist regularly by keeping an eye out for new regulations that the FCC and FDCPA pass. This happens quite often, so you may want to do this frequently, maybe every month, and keep everyone in the loop.

- Use the checklist to train your callers. This doesn’t have to be just new callers who join your organization but can even serve as a refresher for existing employees.

For more details on TCPA and FDCPA regulations for automated debt collection calls, you can refer to these articles:

Must-have features in an automated debt collection calling software

The calling software you choose to make automated debt collection calls with is the most essential and significant investment. So, you really don’t want to make a hasty decision.

Here are a few features that your automated debt collection call software must have.

1. TCPA compliant dialer.

I cannot stress the importance of having a TCPA compliance dialer because you can get fined anything between $500 to $1500 per call if you violate the regulations.

While you can use an automated dialer to make calls to a landline, you can’t use them to call cell phones without consent. And let’s be honest, how many people do you think you reach on a landline?

A TCPA compliant dialer is one that requires human intervention to make a call. Since it doesn’t use an algorithm to dial calls (which is how the FCC defines an automated dialer), agents can make calls to cell phones with it, even without consent.

An example of this is CallHub’s Fastclick Dialer. You can learn more about it here.

2. Calling speed control.

Apart from being TCPA compliant, it’s also important for your dialer to enable you to control the speed of dialling.

Why?

The way you carry out your calling campaign depends on two major factors:

- Size of your contact list.

- The time you have to go through all contact lists.

Say, for example, you have a very large list to go through and a tight deadline. You will have to carry out a high-volume calling campaign (make more calls per hour) to be able to cover it all. But you wouldn’t have to do that for a smaller list.

You’ll be able to control this more easily with the ability to control your calling speed. With CallHub’s Fastclick dialer, you can make up to 10x more calls per hour!

3. Call recording and monitoring.

If you’re wondering why you need this feature, I have two words for you: Quality Assurance.

If your managers have access to call recordings, they can look back at them and get insights like:

- Are callers following all the TCPA and FDCPA regulations?

- Is there anything lacking in the conversations that you may need to train callers for? For example, how to handle debtors who scream at the callers.

- Is the script sufficient to guide conversations, or do you need to add more elements like more talking points for common objections?

Your tool should also allow you to join in live calls and monitor them to provide quick insights to callers if they need it, rather than waiting to listen to the recording at a later point.

4. Reporting and analysis.

Your call center tool should be able to provide you with comprehensive reports on your calling campaigns. At the very least, these reports should include:

- The number of calls made by each agent and the status of each call (whether it was answered, rescheduled, or busy, etc.).

- A breakdown of the pick-up rates for different times of the day for all days.

- The number of people who asked to be added to the DNC list.

- The average talk time and success rate.

- Details about the agent activities (when are they making the most number of calls and when is there a dip in it).

With these reports, you can make informed decisions about what you need to change or update to make debt collection more efficient.

5. Additional integrated communication tool.

When making automated debt collection calls, it’s highly likely that a lot of people will ask you to be added to the DNC list. At this point, you legally can’t call them anymore, which is why you need to look for other ways like texting or email, as long as you follow the FDCPA practices.

If your calling tool itself provides another way to stay in touch with these debtors, it saves you money and effort because now you don’t have to look for another communication tool.

For example, CallHub is both a texting and calling platform. You can download your DNC list and create a separate texting campaign to follow-up with them. You can create a text nurturing flow for this list to ensure they are regularly reminded about their dues or warned about any legal action that you plan to take. And you can do all of this from a single platform!

Can debt collectors send text messages?

Debt collectors are not prohibited from sending debtors text messages. While there are no specific rules about debt collectors and texting, you still have to follow certain best practices regardless of the method of communication:

- You have to identify yourself as a debt collector, and you can’t reveal any details about the debt to anyone except the debtor.

- You cannot send texts repeatedly to annoy the debtor in an attempt to recover the loan.

- Using abusive or profane language is strictly prohibited. You can’t threaten debtors with legal actions that you can’t or don’t intend to take.

- You will have to stop communicating with the debtor through any communication channel if they send you a written letter asking you not to contact them.

These are the most basic features your calling tool must have if you wish to make collection calls efficiently.

These points are a good jumping-off point to start making automated debt collection calls to help you cover more ground and recover more debt. However, the process begins with selecting a call center solution to help facilitate these calls.

Since you’re already here, why not sign up to CallHub for free and give it a try. It checks all the boxes above and more.

Featured image source: Museums Victoria