In his opinion piece published in The New York Times, debt collector Jake Halpern talks about his workday.

It was no surprise to us that most of his time went into making calls.

Reaching out to debtors over a call to discuss payment is an essential part of debt collection. But that’s not the only aspect of it. There’s plenty more that collectors have to do, like debt verification, skip tracing, accounting, etc.

Collectors may often find themselves overworked and unable to do much due to the time they spend dialing numbers and reaching out to people. Not only does it reduce a collector’s efficiency, but it also reduces the organization’s overall productivity.

But what if we told you that there was a simple fix for this? An easy way to make collection calls, save time and improve your productivity.

If that intrigues you, continue reading as we explain how this fix works and how you can implement it.

We’ll start by understanding how traditional debt collection works and its drawbacks.

What is traditional debt collection like?

Traditionally, the debt collection process comprises of the following steps:

- The debt collector cross-references the details of the debt and the debtor.

- The collector then segments the lists of overdue accounts and starts calling them one by one. While many collectors dial these numbers manually, many organizations nowadays use debt collection auto-dialers to speed up this process.

- Collectors who don’t use the auto-dialers have to manually go through the list of contacts, make the call, and try to get debtors to clear their dues.

- They retry the numbers they couldn’t connect with later and go through the same process.

While there might be slight differences in how some organizations operate, most of the process of making debt collection phone calls remains the same.

How does traditional debt collection hold you back?

So what’s the issue with this process?

Well, it’s the loss of valuable time making these debt collection phone calls. Here’s an example that explains this:

Say a collector has to make 100 phone calls in a day.

Now, as per average industry statistics:

- 28% of phone calls are answered.

- 55% are not answered.

- 17% of numbers don’t work.

Statistics also show that the average time for a call to be answered is 28 seconds, and the average time a phone rings before getting disconnected is 60 seconds.

There isn’t much of a wait for numbers that don’t work, so we’ll assume it takes around 5 seconds to dial and identify it as a bad number.

So if a collector makes 100 calls a day, here’s the total time they will have to wait:

| Number of calls | Wait time (seconds) | Wait time (minutes) | |

| Answered | 28 | 784 (28 X 28 seconds) | 13 |

| Not answered | 55 | 1650 (55 X 60 seconds) | 55 |

| Not working | 17 | 85 (17 X 5 seconds) | 1.5 |

| Total | 69.5 minutes |

*For simplicity, we considered all calls going to voicemail and not being declined (which generally happens after 60 seconds).

A collector would typically spend over an hour just waiting and going through bad numbers. And this doesn’t include the time it takes for the collector to add relevant notes after each call or the time it takes to dial these numbers.

If you could eliminate this wait time, it would give collectors more time to:

- Spend on having better conversations.

- Relax and recharge so they can cover more extensive contact lists.

- Spend on other crucial tasks like skip tracing, debtor verification, etc., and close more accounts.

Collectively, this would improve your agents’ productivity, ultimately improving the efficiency of your entire organization.

So how do you improve the process of making debt collection phone calls to eliminate this wait time? We’ll cover that next.

You May Also Like: Debt Collection Tips To Help You Make Better Collection Calls And Improve Recovery

Voice broadcast for debt collection phone calls

Voice broadcasting is a mass communication technique that simultaneously delivers a recorded message to multiple people over a call.

The process is simple— a recipient’s phone rings and an audio message is played when they pick up. (We explain how it works from the organization’s side in the next section)

The recording can be of two types:

- Pre-recorded audio: You record an audio message and upload it to your voice broadcasting tool. In CallHub, you can also record this audio while setting up the campaign itself.

These audio files are suitable for mass messages that don’t need personalization. An example use case for voice broadcasts is announcements.

- Text-to-speech: The text-to-speech function allows you to type in a message, and the tool then converts it into audio. You can personalize this text with merge tags enabling you to fill in details in the message unique to each recipient.

This feature is available in very select tools like CallHub.

How does voice broadcast work for debt collection phone calls?

So how does a voice broadcast help you connect your collectors to a recipient? Well, this is where Press-1 campaigns come into the picture.

Press-1 campaigns are an extension of voice broadcasting solutions. In these campaigns, after the message plays, the recipient presses a designated number, and the call is transferred to a live agent.

The digit to be pressed to connect with an agent must be included in the message. By default, this number is 1 (hence the name), but you can select it to be anything from 0 to 9.

In CallHub, you can have multiple inputs. For instance:

- Press-1 to connect with a collector.

- Press-2 to talk to a customer support executive.

- Press-3 for debt verification.

In these campaigns, calls are automatically transferred to free agents when the debtor presses the designated key.

How to set up a Press-1 campaign for debt collection

Now that you know how press-1 campaigns make debt collection phone calls more efficient, let’s see how you set them up.

We’ll be walking you through setting up a campaign in CallHub. Here’s how it goes.

Step 1: Adding the message

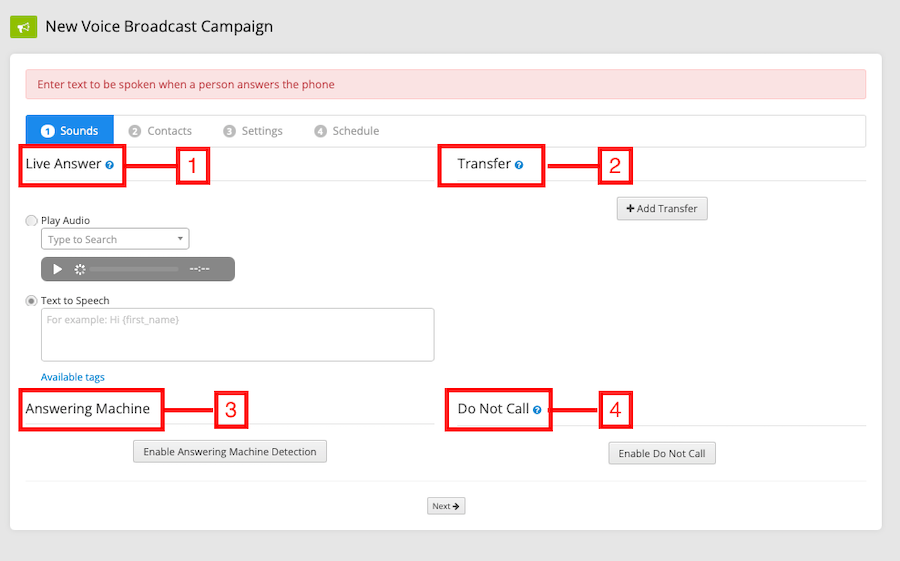

The first step of the setup is adding the message to be played. In CallHub, there are four aspects of the call that you can customize.

1. Live Answer

Live Answer is the message that plays when a debtor answers the call. As you can see, you can either upload a file or type in the message to turn into audio (with merge tags to personalize it).

Make sure to mention the call transfer digits in the message.

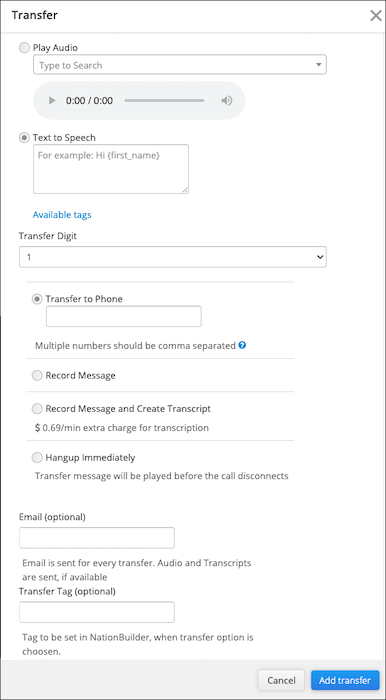

2. Transfer

This is where you add the details for the call transfer. These include:

- Transfer message– The message to play after the transfer digit is pressed. For example, “Please hold while we transfer your call.”

- Transfer to phone– Add the number to which you wish to transfer the call. You can add multiple numbers here if you don’t want too much traffic on one number.

- Record message– The option to let the debtor record the message after pressing a designated digit.

- Record message and create transcript– The option to record the message and get the transcript for the same.

- Hang up immediately– This is used to hang up the call after the Transfer Message is played. This feature is ideal for one-question surveys.

3. Answering machine

Enabling this option lets you automatically drop a voicemail if a call is sent to the answering machine. This feature saves you even more time by ensuring only live calls are transferred.

You can record separate audio or type in a collection voicemail script for this too.

4. Do Not Call

This option comprises the message that plays if a debtor presses a DNC digit. For example, “Thank you! Your number will be removed from our list.”

You can even set the Do Not Call digit here. Contacts who press this digit will be added to a DNC list and receive no more calls. This helps ensure that your debt collection phone calls are TCPA compliant.

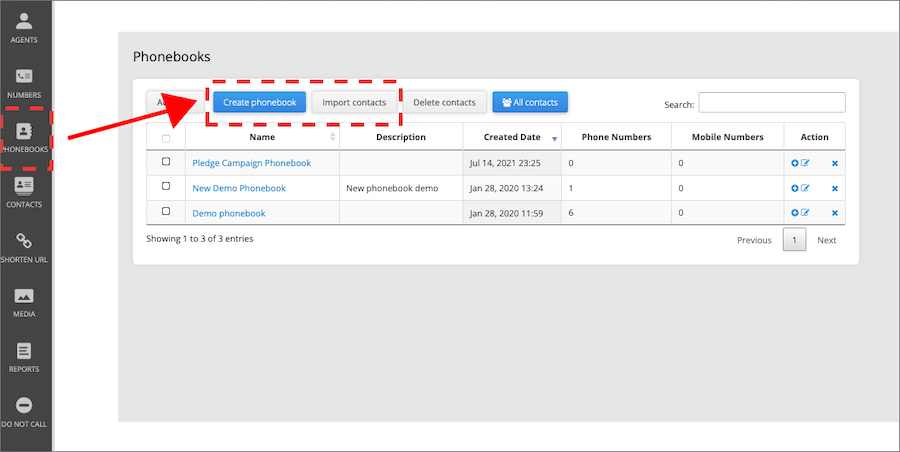

Step 2: Selecting the contacts

Here, you select the contact list with the contacts you wish to call. These contact lists should be uploaded before creating the campaign.

In CallHub, you can do this by selecting the contact list option from the sidebar. You can either upload a CSV file or import it directly from your CRM.

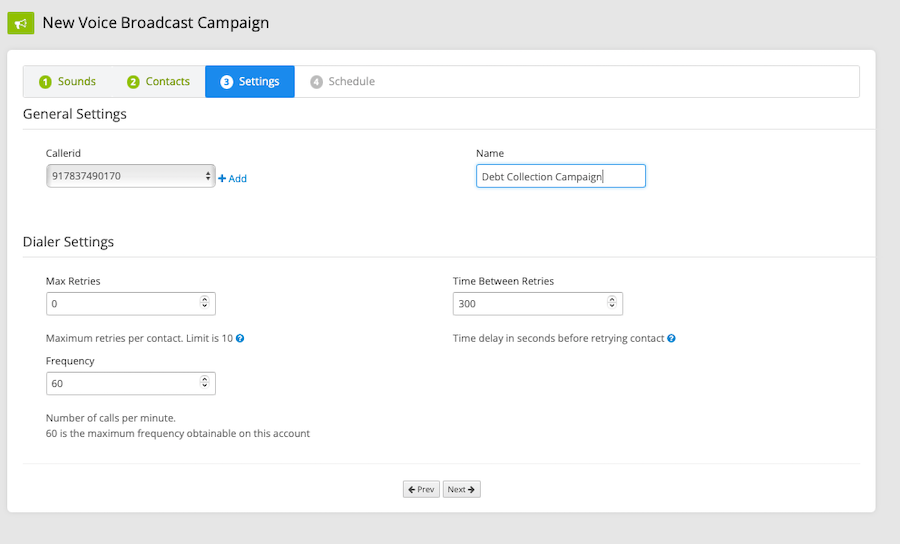

Step 3: Customizing campaign settings

This stage comprises of general and dialer settings like:

- Caller ID: The number you wish to show on the recipient’s phone. This can be the same or different from the transfer number.

- Max retries: This refers to the number of retries per contact for unanswered calls. You can set any number between 0-10 here.

- Frequency: The number of calls you want the tool to make per minute. You can set this number based on the size of your contact list and the number of collectors working.

- Time between retries: The delay in seconds before redialing an unanswered number.

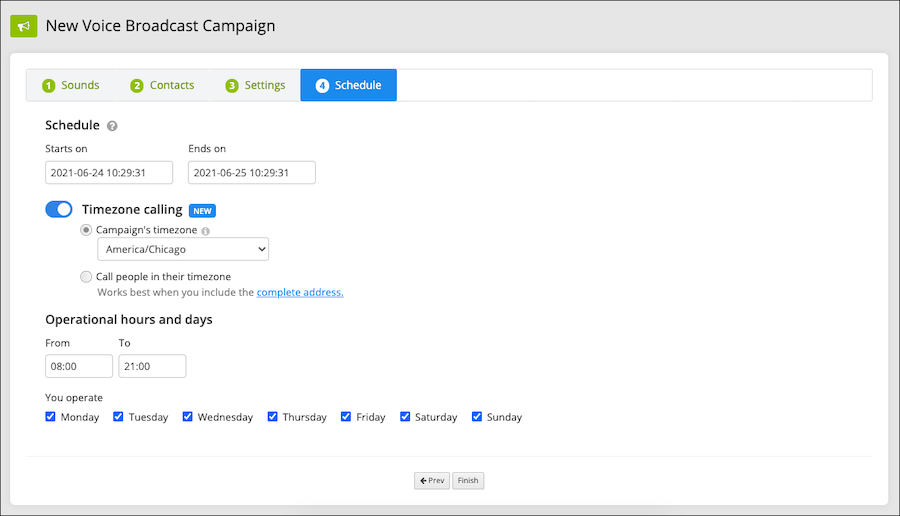

Step 4: Set campaign schedule

The campaign schedule is another essential aspect that helps you ensure your debt collection phone calls are TCPA compliant.

Here’s what you need to set here:

- Campaign start and end date: The dates through which you want the campaign to make calls.

- Timezone: This allows you to choose the timezone of the campaign. If not selected, the timezone of the account is applied.

- Daily operational hours: The days and times when you want the campaign to make calls. You can set this as per the state permitted hours to make debt collection phone calls.

Once you’re done, click finish, and your campaign goes live as per the schedule.

Read Next: The Most Essential Tools Your Collection Call Centers Need To Improve Debt Recovery

Additional features that can boost your calling efforts

We’ve covered how Press-1 campaigns can improve productivity and help you make debt collection phone calls more efficiently. We also covered how to set up such a campaign.

Now let’s go over some good-to-have features that can ramp up the impact of your calls.

Answering machine detection

This may not be a necessary feature, but it helps you save a lot of time by eliminating the need to leave voicemails manually.

When the answering machine detection feature detects an answering machine, it automatically drops a voicemail. The voicemail can be a pre-recorded audio or text-to-speech. This happens in the backend, and the call is not transferred to any agent.

Dynamic caller ID

Did you know that people are four times more likely to pick up a call from a local number? The dynamic caller id feature helps you with that.

It displays a local caller id on the recipient’s phone. If you’re making calls out of the state, it automatically rents a local number for you and displays it.

Fastclick dialer

Want to call cell phone numbers? Unfortunately, you can’t use an autodialer to do that if you don’t have prior permission from the contact.

The Fastclick dialer, however, is an alternative that you can use. While the tool takes care of queuing and call routing, the calls are initiated manually with an agent clicking a button.

This helps you make calls to mobiles at speeds comparable to auto-dialers while staying compliant. Learn more about this TCPA compliant dialer here.

Agent analytics

It’s important to know if your callers are performing their best and the agent analytics dashboard helps you do that.

CallHub’s analytics dashboard even lets you gamify the process by ranking all callers based on their performance so you can reward the top performers and keep everyone motivated.

What next?

If you’re an organization that’s growing or wishes to grow, a voice broadcast solution to make debt collection phone calls can really give you the push you need.

If you feel like this is something you need, your next step would be to look for a tool to help you make these calls.

CallHub is a calling tool with a comprehensive voice broadcast solution that you can consider. Call it a humble brag, but our solution not only has all the good-to-have features mentioned above but also texting solutions that can ramp up your outreach.

Sign up for the tool here and take it for a trial run for free. You won’t be disappointed.

Feature image source: Photo by Quino Al on Unsplash