MYOB, a business software provider, analyzed over 213,000 accounts invoices, and they found that 49.6% of all invoices typically become overdue.

For businesses, this is a big challenge because it ties up working capital, whereas for agencies, it demands more resources to close accounts quickly.

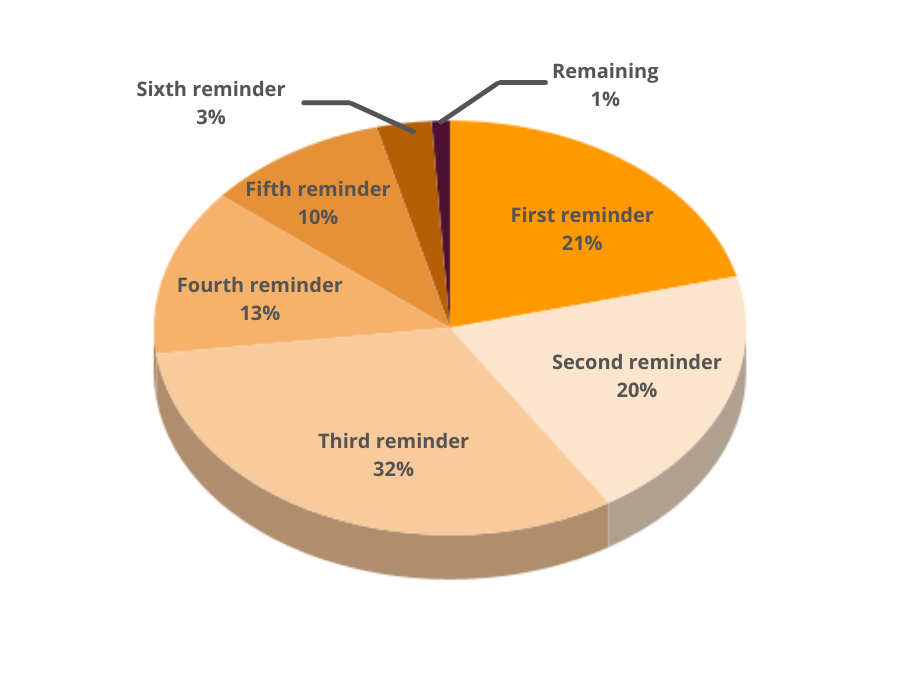

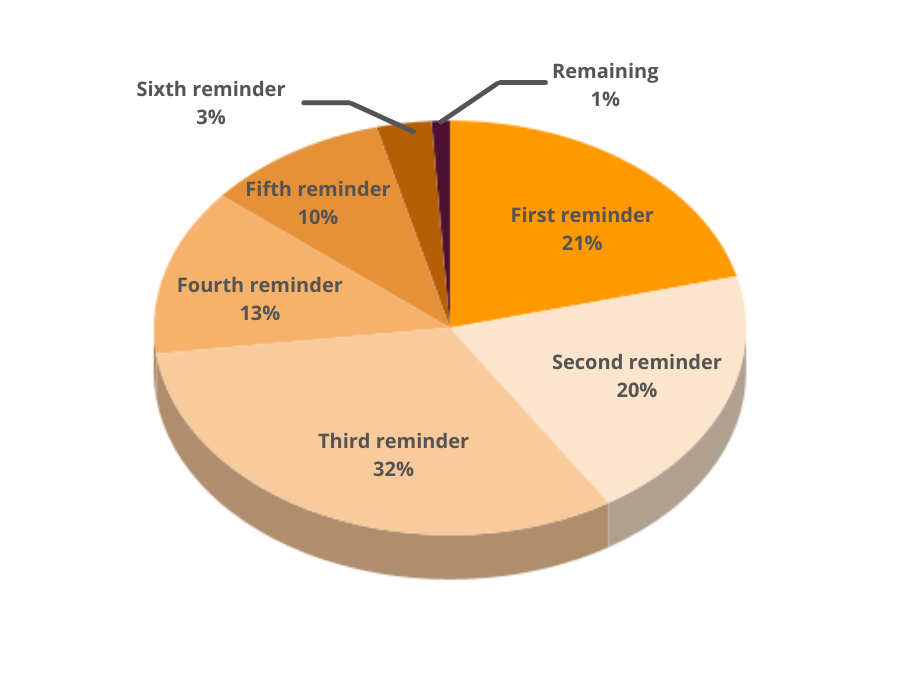

However, there is an easy fix to this. The same survey also found that payment reminders can help you prevent overdue payments. Here’s what they found:

- 21% of invoices are paid on first follow up (typically an email reminder)

- 20% are paid after a second reminder

- 32% are paid after the third reminder

- 13% are paid on the fourth reminder

- 10% are paid on the fifth reminder

- 3% are paid on the sixth reminder.

If you take a closer look, you’ll notice that by the sixth reminder, 99% of all your overdue debts will be cleared.

You can’t escape sending out several reminders to collect payments. But you surely can improve your efforts to get better numbers in the first few prompts.

In this post, we’ll discuss some best practices for debt collection reminders to help you close your accounts quicker.

Best practices for debt collection reminders

When it comes to sending reminders, there are a few aspects that you need to consider. These include the following:

- Timeline– When you should start sending the reminders and until when.

- Messaging– The content of the reminders.

- The tone of messaging– How your message should be perceived.

- Distribution channels– Ways to send out reminders to debtors.

These aspects collectively decide the impact your reminders have on debtors.

Let’s take a look at the best practices of each of these aspects.

Timeline

Ideally, you don’t want to wait for too long or send too many reminders at the last minute before getting your payment. So it’s recommended that you start as early as possible.

#1: Send the first reminder before the due date

Debtors often don’t keep track of their payment dates. So it’s a good idea to remind them when their date is close. Maybe a day or two before the due date, you can send them an alert to let them know that their due date is near. If there is an advantage of paying the debt on time, mention that too to give them that extra push.

#2: Send the second reminder immediately after the due date

After the due date, it’s recommended that you act quickly and don’t wait too long. A quick reminder is a sign of your organization’s efficiency and seriousness about the receivable.

#3: Don’t send more than four automated reminders

The keyword here is automated. These could be automated texts or emails (including the first one before the due date). By the fourth reminder, generally, most of your debtors would have made their payments if they could. But if they didn’t, it is time to get in touch with them over a call or in-person to discuss if there’s an issue.

#4: Avoid mentioning the reminder number

When you use words like “first reminder” or “second reminder,” it gives the idea that there may be more to come. Debtors might take this casually and may not act on it immediately.

Messaging

The messaging of your debt collection reminders should ensure that the debtor is aware of the outstanding debt and has all the details they need to make the payment.

#1: Mention the due date in all reminders

Whether it’s the first reminder or the fourth, make sure to mention when the payment is/was due. In the first reminder, it’ll act as a deadline to follow. In the following ones, it’ll reinforce the seriousness of making the payment, but in a non-threatening way.

#2: Specify the debt amount

For any debt collection reminder, this is a given. Since debtors may not keep track of their amounts as closely, make sure to let them know precisely how much they owe you.

#3: Include payment options

To increase your chances of getting the payment, you have to make the process easy for the debtor. So make sure you provide them with multiple payment options and let them know about it in the reminders.

#4: Add your contact information

You don’t want to wait for long to find out that the debtor cannot pay immediately, or wants to negotiate a new plan, or has some trouble in the payment process. This is why it’s recommended that you provide debtors with a way to get in touch with you to discuss any issues they may be facing. Make sure to include this information in every reminder.

Tone of messaging

One best practice for debt collection reminders that is often overlooked is the tone of the messaging. Your tone makes a significant impact on how the debtor perceives the message. This, in turn, affects their relationship with you, which is why it’s essential to be mindful about how you craft your reminders.

#1: Use a friendly tone in the first two reminders

You don’t want to start aggressively and stress out the debtor. That doesn’t pave the way for a good relationship moving ahead. Also, there is a good chance that the debtor simply forgot about the debt and will pay you after a friendly reminder. There’s no need to come off too strong here.

#2: Be more assertive but non-threatening in the third and fourth follow-up

If you haven’t received the payment yet, there is a possibility that the debtor might be taking your reminders casually. Use a slightly assertive tone than the previous reminders to ensure that the debtor takes it seriously. But make sure you don’t sound threatening because that is against the FDCPA regulations.

#3: Smile when you talk to debtors over call

After multiple reminders, if you are to get on a call with the debtor, make sure to smile and converse with them. At this point, there is a good chance that the debtor is struggling, and you may need to negotiate a new payment plan. But the debtor will only open up about it if they feel heard and can freely have a conversation to explain things to you. A smile goes a long way here because they can hear it and find it comforting even though they don’t see it. Plus, it’s really good phone etiquette.

Distribution channels

Another overlooked best practice for debt collection reminders is the distribution channels. You have to use the right ones to ensure your message gets across and has the impact you intend to have.

#1: Use text and emails for initial reminders

A McKinsey report showed that people were 12% more likely to make a payment when contacted through their preferred communication channel. Text and emails were among the top preferences. Plus, for initial reminders, you don’t have to come off too firm, so email or text reminders work pretty well.

#2: Use more personal channels for the third and fourth reminder

By the time you get to these reminders, the chances are that your message may have gotten lost among other communications. In such cases, you can move to slightly more personal channels like voice broadcasts. A voice broadcast reminder is hard to miss yet not too invasive either.

You can learn more about Voice Broadcast campaigns and how to set them up here.

#3: Get in touch with debtors over a call after all reminders

If the debtor has been unresponsive through all your reminders, chances are they are trying to avoid you or are unable to pay right now. In either case, you will need to have a dynamic conversation with the debtor to clear the air and negotiate.

Plus, connecting over a call after a few reminders is also great because a majority of debtors would have already acted on your automated reminders earlier. Therefore, you’ll have a smaller list to target at this point, thereby helping you use your resources more efficiently.

Moving forward

Now that you’re equipped with some best practices for debt collection reminders, it’s time to execute them. The good news is that none of them would take a lot of effort, so you can work on them parallelly.

You can start by creating a calendar to schedule debt collection reminders and then move on to crafting your messaging for each reminder (with the right tone). Finally, get the right communication tool to help you out with the outreach, and you’re all set.

And while you’re here, why don’t you sign up to CallHub and take it for a free trial run. This comprehensive communication platform provides you with all the calling (automated collection calls, voice broadcasting solution) and texting solutions (SMS broadcast, peer-to-peer texting, SMS opt-in) that you need to send out effective debt collection reminders.

Featured image source: Photo by Kelly Sikkema on Unsplash