As a communication platform, giving you debt collection text message samples is something we can perfectly do! But first, let’s explore why text messages are slowly emerging as the preferred mode of communication for debt collection.

Debt collection has been traditionally conducted through calls, letters, notices, and voicemail. However, as technology has progressed and the key demographic targeted by debt collectors has changed, other communication modes have gained precedence.

According to a study by McKinsey and Company, digital outreach methods such as text messages, emails, and online chat are more effective in debt recovery. When contacted through their preferred mode of communication, most digital-first clients are 12 percent more likely to make a payment.

This study highlights the need for debt collectors to shift from traditional, more ‘aggressive’ methods like calls and notices to relatively ‘passive’ digital modes of communication like text messages. And we’re here to help you with text messages with our debt collection text message samples.

Let’s explore how you can leverage text messaging to reach out to and gain responses from clients.

Benefits of using text messaging for debt collection

1. Higher response rate

As a debt collection medium, text messages fare much better than any other traditional outreach method. With an open rate of 98% and a response rate of 45%, text messages are a sure-shot way of not only reaching out to your clients but also eliciting a response from them. Compare them to 6% response rates for emails, and you have a clear winner!

2. Debt collection sms is cost-effective

The cost for sending out debt collection sms is far lower than any other traditional debt collection method. Sending out timely payment reminders, overdue warnings, etc., through mass texting campaigns are a quick and cheap debt collection method.

With CallHub, you can reach out to 88 people via texts by spending as little as $3, with texts starting at $0.034 / text.

2. Debt collection sms provides instant reach

Not sure if your client will pick their phone to answer your call or if it will end up on voice mail? Worried that your debt collection email will be lost among hundreds of other emails in your client’s inbox? Text messages can cut through the noise, and you can rest assured they reach your client. How? Because 95% of text messages are read within 3 minutes of being delivered. That’s an incredible statistic to know that text messages are the best way to channel your debt collection outreach.

4. Debt collection sms improves client relations

An alternative way to use text messages for debt collection is to nurture client relations. When clients pay on time, you could share thank you messages showing your appreciation. You could also set timely reminders to remind clients about upcoming payments – this way, it avoids any unpleasant communication when payments are missed. Sometimes, for all you know, a client might have just forgotten to pay. A non-invasive, non-threatening text message can go a long way in making the client feel good about working with you.

5. Debt collection sms can help you save time

At the click of a button, you can launch your debt collection sms campaign. Now compare that time to the time taken to make, say, 30 phone calls. Which seems like a better time investment for your company?

Sending text reminders, text follow-ups, etc., and reserving calls only for when necessary save your time and allow your team to prioritize other vital tasks.

6. A debt collection text creates a sense of urgency

When people receive timely reminders, updates, and communication from you via text, you are constantly on their minds. Constant communication is a great way to create a sense of urgency when it comes to timely payments. The longer the time taken to pay back dues, the lesser the percentage of debt recovery that might occur.

7. Debt collection sms is less stressful

Being on the receiving end of debt collection communications can be a really stressful experience. As a comparatively non-invasive form of communication, texts help create a more relaxed relationship with your clients and encourage them to continue talking to you.

Before setting up your text message campaign, it is also essential to know the compliance rules that a debt collection agency must know. We’ve looked up some basics to help you make a start.

You May Also Like: Debt Collection Tips To Help You Make Better Collection Calls And Improve Recovery

Can debt collectors send someone a text message?

Debt collectors can send their clients text messages if the client has consented to receive them. If a client has not agreed to receive sms or email notifications from a debt collector, it will be against the law to reach out to them via these mediums.

Therefore, as debt collection agents, you must ensure that your clients consent to receiving debt collection sms alerts from you. At CallHub, we offer a feature called SMS opt-in which can quickly solve this problem.

You need to rent a keyword and a number and share it with your clients. Once your clients message you with the keyword, they have ‘opted-in’ or consented to receive communication from you. You can receive their consent while handing out the loan and obtaining permission to contact your clients.

Note: A text messaging mandate is always to ensure that your clients can opt-out of your messages at any given point. This ensures that you stay compliant with the law and also maintain a healthy relationship with your client. You are also allowed to send messages only between 8 am to 9 pm as per regulations.

Let’s explore different ways in which you could use text messaging for debt collection.

Debt collection text message samples

From sharing payment reminders to staying in touch with clients by keeping them informed about compliance laws, there are numerous reasons to use text messaging for debt collection. We’ve come up with debt collection text message samples that you can feel free to copy and use!

Also watch: 5 SMS Marketing Best Practices

1. Automated payment reminder template

Scheduling a payment reminder campaign on a recurring basis? Here’s a sample text you can use:

| Dear <First Name> Your next payment for amount <sum> is due on <date>. Please ensure you make the payment on time to avoid further costs. Thank you <agent/company name> |

You can use this debt collection text message sample when you want to send a soft reminder ahead of time – when no payment default has occurred.

2. Keep clients informed about payment compliance

A simple way to keep clients engaged and inform them about payment compliance is by sharing small informational messages. It is a polite and non-confrontational way of letting clients know the consequences of non-payment. You could also let them know about changes in debt laws in general or any benefits they may receive by paying earlier than expected.

Please note, this needs to be used as an educational initiative rather than a form of threatening the client.

| Dear <First Name> According to the law, debt collectors can only reach out to you between 8 am and 9 pm. We at <Company Name> take pride in following text compliance laws. |

3. Share payment confirmations

You can set up automated text messages for when a client makes payments and clears dues. Payment acknowledgment messages clear any confusion about the payment status. They are also an excellent way to build relationships with your clients by thanking them for timely payments.

| Dear <First Name> This is to acknowledge the receipt of the amount <sum> towards your car loan. Thank you for being a valued customer. <Agent/Company Name> |

| Hey <First Name> Thank you for payment of amount <sum> towards your home insurance. Reply with REMIND ME if you want us to send you payment reminders each month. Regards |

4. Set up auto-responders for FAQs

You can set up your communications platform to send out automated messages for frequently asked questions. It minimizes time spent on calls answering questions and instead helps your agents focus on reaching out to more clients instead.

An easy way to set up this system is through features like SMS opt-in offered by CallHub. When you purchase a membership with CallHub, you can select an unlimited number of keywords that your clients can then use to ask you questions if you choose.

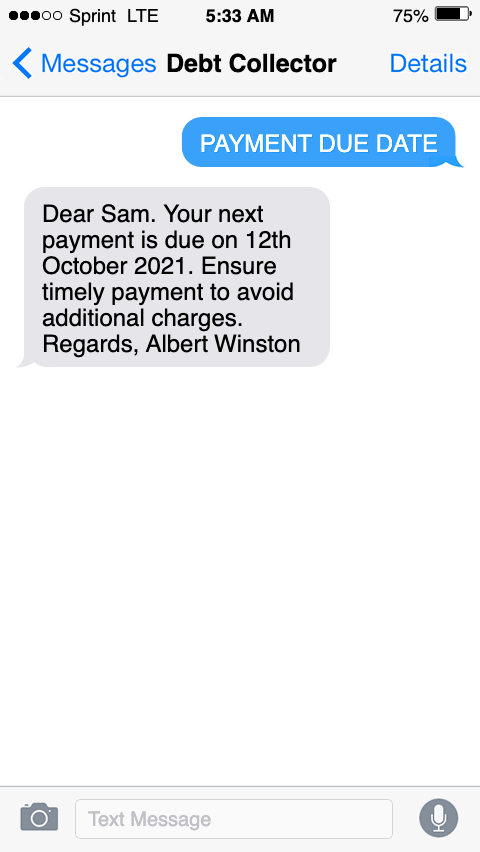

Here’s an example of how SMS opt-in can be used by clients to ask for their payment due dates:

5. Send bulk reminders for payments

If you do not want to send individual messages, you could also send bulk payment reminders. This way, you do not need to schedule reminders on different days and can send out a campaign all at once.

Use merge tags to personalize the texts and get an even better response rate. In a 2018 study, marketers said personalized text messages improved customer experience by almost 55%.

Read Also: Personalized Text Messages – Get Started (With Examples!)

| Hello Your invoice for the month of October has been issued. Kindly make the payment before the due date to avoid having your account restricted. Thank you <Company Name> |

6. Share links for quick payments

As a debt collection agency, it is important to assess if one of the reasons for default payments is the payment method itself. Are clients finding it hard to make payment through traditional methods and would like a more straightforward way to clear dues?

This is another way in which debt collection sms can help you. Find out if your text messaging partner has a URL shortener/tracker feature through which you can share URLs via text to facilitate online payment. CallHub’s recently launched URL shortener and custom URL features have our partners buzzing with excellent feedback!

| Dear <First Name> Payment is now easier than ever. Follow the link chub.io/pay to clear dues for the month of November. Thank you, <Company name> |

7. Follow up on payment

A late payment follow-up through text needs to be concise and encourage clients to clear dues at the earliest possible time. A debt collection sms that communicates just that without turning hostile is the key to successful payment.

| Hello <First Name> You have pending payment for June. Please clear your dues at the earliest to avoid further charges. For assistance, reply HELP. <Company Name> |

While this debt collection sms is strictly asking for immediate clearance of dues, it is also open to understanding if the client needs assistance of any kind. This should open up the client to share any issues they might be facing with payment.

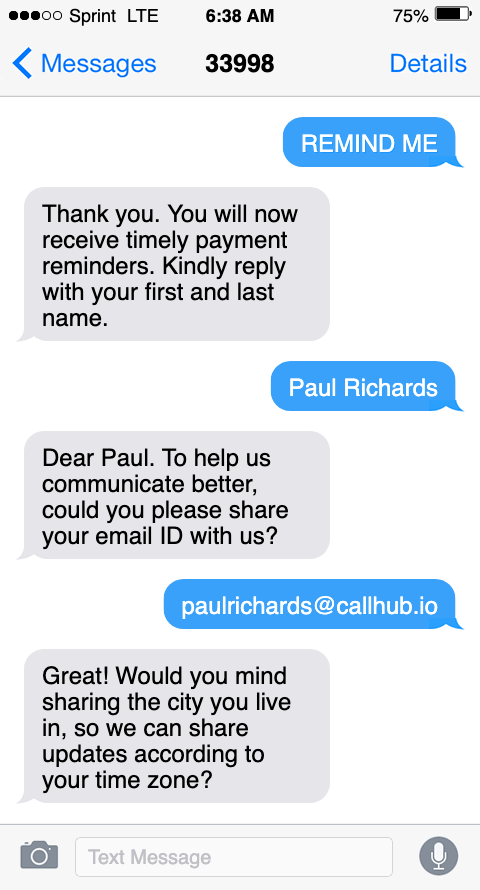

8. Collect information about your clients

A text message can go beyond working as a payment reminder system. It can also help you optimize your debt collection process by knowing more about the people you are dealing with.

Just as people need to opt-in to your debt collection sms service, you can set up autoresponders for them to give you more detailed information about themselves. You can personalize your data collection by following this sample text:

9. Overdue Reminder

When a client misses out on payments several times despite follow-ups, it might be a good time to let them know about the consequences of further delay. The idea is to create a sense of urgency to make the payment to avoid legal hassles.

Note: If you do not intend to pursue legal action, you cannot by law threaten to take that action. Neither are debt collectors allowed to threaten or harass a debtor.

| Dear <First Name> Due to failure in payment of <sum> despite warnings, we will be taking further action. Our attorneys will notify you of further steps. |

10. Encourage two-way communications to resolve issues

Sometimes, people are people, and they tend to forget something as important as paying off their debt. Other times, they may be struggling with technology or other issues related to payment.

To avoid miscommunication and handle your clients’ issues better, you can facilitate two-way conversations through text.

We suggest exploring peer-to-peer texting through which your agents can have personalized conversations with hundreds of people simultaneously.

Now that you have a few debt collection text message samples, we’re sure you’re ready to use text messaging as a communication tool for debt collection. We’re here to help you get started with your campaign.

How to get started with debt collection sms?

We’ve listed a few easy steps through which you can get started with text messaging on CallHub. Here goes:

- Create a CallHub account: Visit https://callhub.io/signup/ and signup today!

- Rent a keyword: A keyword could be anything meaningful related to your business that a client can use while texting you. ‘JOIN’ ‘REMIND’ ‘STOP’ ‘PAYMENT’ – are all examples of keywords you can use.

- Set up different campaigns: Set up payment reminder campaigns, follow-up campaigns, thank-you campaigns, payment acknowledgment campaigns – whichever suits you best.

- Train agents: Train your agents to set up or launch campaigns. You could also guide them on best practices when working with peer-to-peer texting so that they are ready to answer any question a client might have.

- Hit the launch button! You’re all set, and your campaign is on its way to help make your process easy.

CallHub offers a free 14-day trial to help you get started. Sign up now!

Featured Image Credit:Anete Lusina