Table of Contents

Insurance distribution channels shape how your products reach customers, how you interact with them, and ultimately how you grow revenue. In 2025, distribution is no longer just about agents and brokers—or choosing between “old-school” human sales and direct online models. Instead, winning insurers are building hybrid, always-on systems that let customers buy how and where they prefer, blending trusted human relationships with fast, digital-first journeys powered by modern outreach tools.

What insurance distribution channels are

Insurance distribution channels are the ways insurance companies sell their products and connect with customers. This includes traditional methods like agents and brokers, as well as newer options such as buying insurance online, through comparison websites, or as part of another purchase (embedded insurance).

In the US, independent agents and broker-dealers still play a major role in selling products like annuities. However, digital platforms are growing quickly and now support these traditional channels. As a result, spending on insurance distribution technology in the US is expected to more than double between 2023 and 2029, driven by insurtech partnerships and customer demand for faster, self-service options.

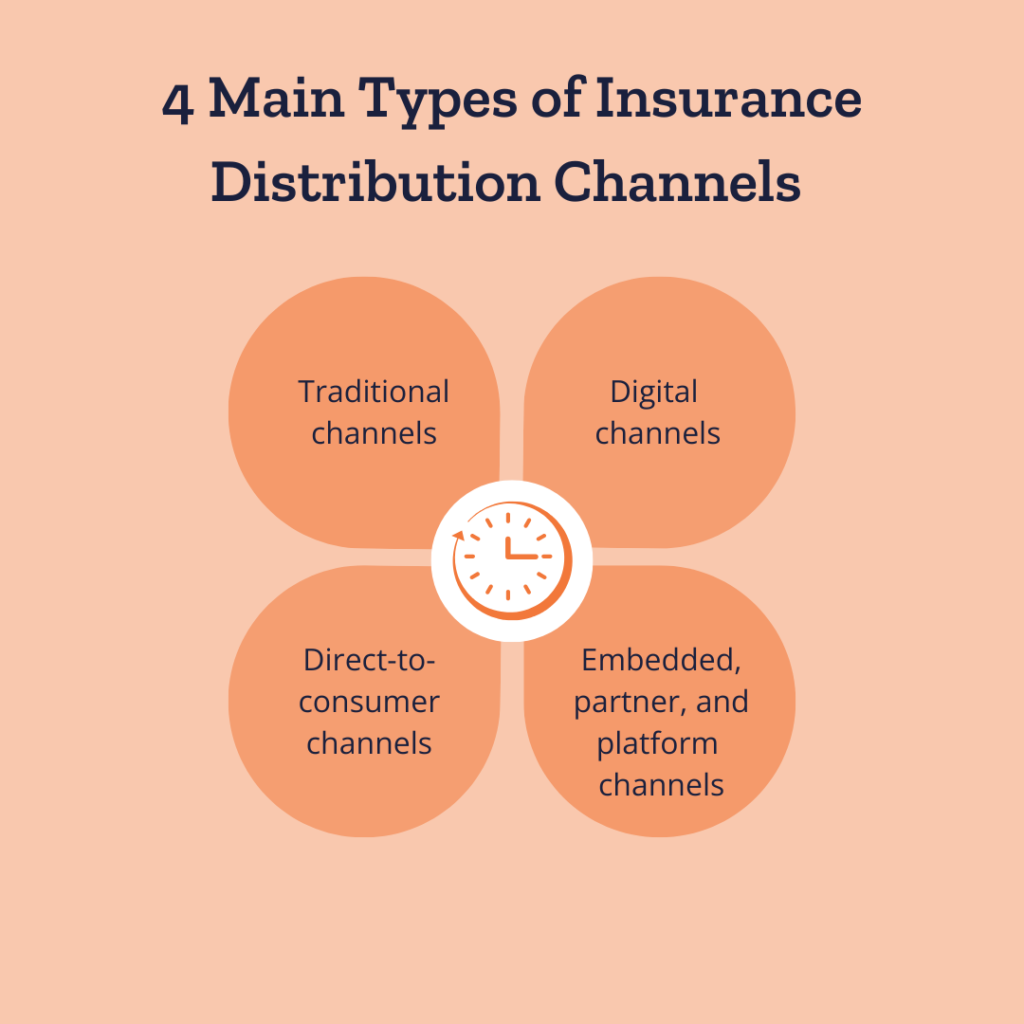

Main types of insurance distribution channels

This section gives you a concise view of the major insurance distribution channels you can use in 2026.

Traditional channels

Traditional channels still handle a big share of premium and remain critical for complex products and higher-ticket sales.

- Captive agents: Sell products for a single carrier, often with strong brand alignment and training.

- Independent agents and brokers: Offer products from multiple insurers, giving customers more choice and comparison options.

- Bancassurance (bank-led): Banks distribute insurance products alongside accounts, loans, and wealth offerings, leveraging their existing customer base.

- Direct mail and phone sales: Outbound mail and calling campaigns that reach specific segments, often older or high-net-worth clients.

Even as digital grows, insurers are still allocating around one-third of volume through independent agents in some markets, because customers continue to value advice on complex life, health, and commercial policies.

Digital and direct-to-consumer channels

Digital and direct-to-consumer channels are where growth and margin opportunities are accelerating.

- Insurer websites and portals: Prospects research, quote, and sometimes bind policies directly online, often with live chat or video support.

- Mobile apps: Provide always-on access for quotes, policy management, and claims, and can prompt cross-sell or upsell.

- Web aggregators and comparison sites: Let customers compare multiple insurers and channels in one place, then click through to buy.

- Direct response marketing: Campaigns that drive immediate inbound calls, texts, or online actions via email, SMS, paid ads, or TV/radio.

- Social and content-led funnels: Content, webinars, and social ads that capture leads, nurture them, and push them into your preferred sales path.

One 2025 survey cited that around 90% of policyholders prefer to interact with their carrier through digital channels, such as websites or mobile apps, in at least part of their customer journey.

Embedded, partner, and platform channels

A major evolution since the original version of this blog is the rise of embedded insurance and platform models.

- Embedded insurance: Insurance is offered at the point of sale for another product (e.g., travel coverage at checkout, cyber coverage bundled with software).

- Fintech and neobank partnerships: Banking and fintech apps embed or cross-sell insurance using APIs and shared data.

- Marketplaces and ecosystems: Platforms where multiple carriers and MGAs list products, supported by shared data, underwriting rules, and digital workflows.

- Peer-to-peer and community models: Groups of customers pool premiums or share risk through digital communities, often in niche segments.

These channels often rely on distribution technology to orchestrate quoting, binding, and commissions behind the scenes, while the customer sees a simple, contextually relevant offer.

While there is a wide range of insurance distribution channels to choose from, it is also essential to explore how best they can be utilized by overcoming digital buying hesitancy.

We’ve listed down a few ways in which your transition to digital channels can be made more accessible.

Planning your move to digital insurance distribution channels

The benefits of buying insurance online are myriad for the consumers. To begin with, they can:

- Compare policies online and find out which one suits them best.

- Gather information and reviews from other consumers online without an agent upselling a more commission-worthy product.

- It is easier to make a transaction online than go through the paperwork and payment process offline. Also, it can be done in the middle of the night at the customer’s convenience.

Therefore, eventually, digital selling is going to take over the market share of insurance distribution channels. While that change gradually occurs, being prepared and ready to go will help you be the front runner in this change. Here are some ways for your to start moving to digital.

1. Simplify your product for online selling

Frequently insurance products are described and sold using the language of sales and insurance. While it may make a lot of sense to the agent or broker, it may not always communicate to the consumer.

For digital selling, it is easier if the product description is simplified in a manner that the end consumer easily understands. If it seems too complicated, it would be easier to regress to the old method of calling up an agent or broker to explain the policy.

2. Talk to your existing customers

Every business has a customer base willing to move with them no matter what shifts occur. Identify your loyal customer groups and introduce them to the digital insurance distribution channel that you’ve chosen.

This serves you in two ways:

- You get to test if your new distribution channel is working and simple to use.

- Once the ball gets rolling, more and more people will get comfortable with online selling.

Engage your existing customers and see how it impacts your move online.

3. Build a remote workforce for your insurance distribution channels

Remote workforces benefit insurance companies in many ways. To begin with, a remote sales force can serve a larger group of people than traditional methods, thus resulting in lower commission costs per sale. And nowadays, you can do everything from remote system management to payroll from the comfort of home.

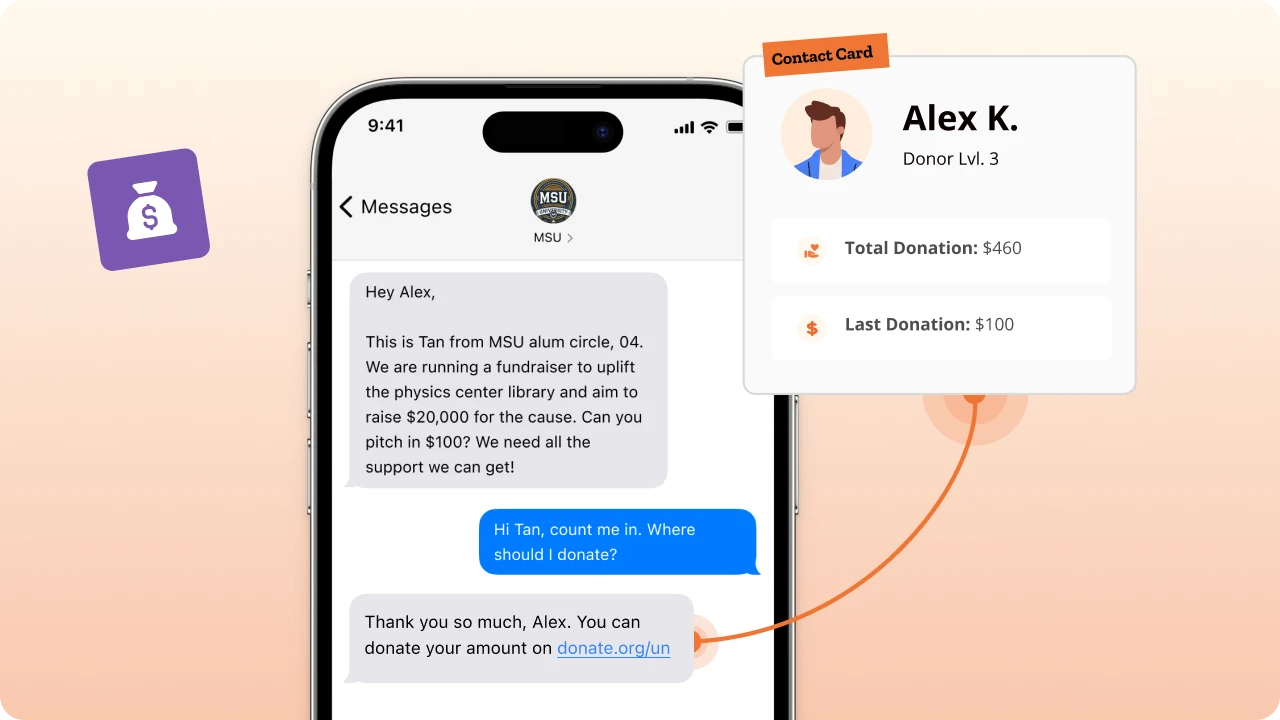

Using tools such as the calling and texting features offered by CallHub, insurance companies can easily coordinate remote working efforts.

For example, through CallHub, managers can automatically update calling scripts or craft text message templates that can be used by all agents that log onto the system. Furthermore, a standardized FAQ list can also be provided to the agents to make calls.

By expanding your team to a remote sales force, you can end up with a sales team that is more efficient at relationship building and closing deals.

4. Foster team spirit within the organization

Since digital distribution channels are new for your team, figure out ways your team can still collaborate and make a difference.

You can start by making your team attend digital selling workshops together, discussing new strategies to optimize sales, share feedback from their new workflow, discuss how new tools are working for the team and allow them to help each other out during this transition.

Fostering team spirit at this crucial juncture of change is going to build your base for the future.

5. Identify gaps in your journey

When planning your move to digital insurance distribution channels, map out your entire journey from the product to the end consumer. Figure out where players such as agents, brokers, banks, and other intermediaries come into the picture.

Designing your workflow keeping each factor in mind will help you better prepare in advance and foresee any difficulties in your shift online.

Find out which tools might help you bridge the gap in your journey if there is any challenge in a particular area.. 44 percent of agents rated either digital agent tools or customer tools as the number one capability insurers can invest in to support them right now. Invest in those tools to accelerate your growth in the initial stages.

6. Explore SaaS products

SaaS products will help you immensely in your move to online insurance distribution channels. From streamlining your workflow to managing your contacts, there is a lot that a good SaaS product can do for you.

Here are some benefits of using a SaaS product:

- It helps you nurture your relationships with the customer by offering tag features and managing outreach methods.

- Provides consumers with personalized communication through all channels used by them.

- Provides you with reports to determine winning strategies, areas for improvement, and other metrics.

- Analyzes and predicts consumer behavior for better targeting and results.

- It integrates with third-party applications to improve your lead generation, lead nurturing, and social media outreach efforts.

7. Gather Data for your insurance distribution channels

When starting something new, like your transition to digital insurance distribution channels, the best thing to do is research and gather data.

Look at trends from other insurers who have also begun their shift to digital, ask questions to your consumers, or analyze the results within your team. There are many ways to gather data. It would help to ask yourself these questions:

- What are some strategies that competitors have implemented?

- What can your team do differently?

- What are the latest trends in the market?

- Are customers comfortable with the new strategy?

- What metrics and goals can be achieved on a monthly, quarterly, or yearly basis?

- Do agents need new or upgraded lead generation tools?

- Do agents require specialized communication tools?

- Do I need to spend more time on training my staff?

These questions would give you a rough idea about areas of improvement and might also help you see things from a new perspective.

8. Find the perfect mix between insurance distribution channels

When starting, it is important to experiment with different insurance distribution channels to figure out which one works best for you. Laying all your eggs in one basket might be risky in the initial stages.

In any case, different channels of insurance distribution bring in different types of clients belonging to different demographic segments and with different needs. Using a combination of distribution channels increases your chances of success.

9. Stay alert for trends

When working in tandem with the technological sector, it is always a good idea to stay alert for trends and figure out new advancements in technology in your space.

Often, the first few market entrants to use certain products and offer new features see the maximum success. Stay ahead of your competitors by always learning.

Where CallHub fits in your insurance distribution channels strategy

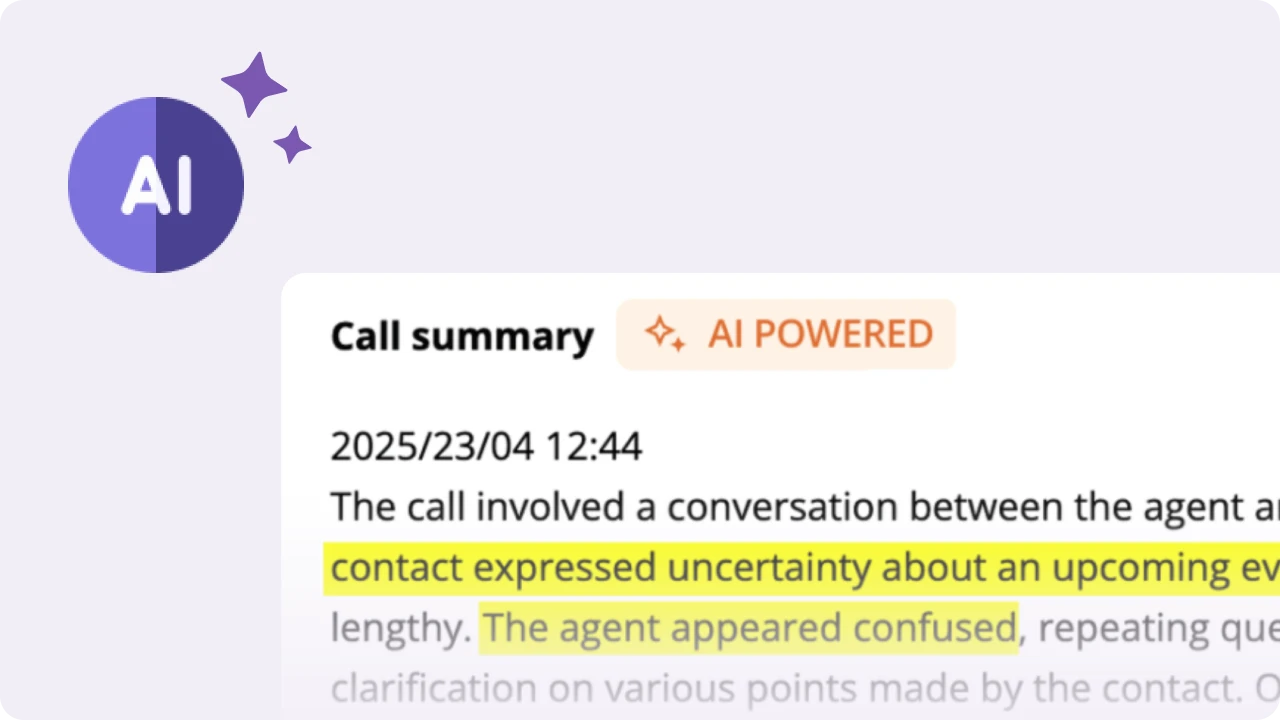

CallHub does not replace your channels; it amplifies them by helping you talk to more of the right people, faster, while maintaining compliance.

Powering agent and broker-led distribution

If you rely heavily on agents and brokers today, you can use CallHub to:

- Run outbound calling campaigns to follow up with leads from aggregators, partner banks, or trade shows.

- Display dynamic calling scripts that agents can follow, adapting in real time to customer responses.

- Log notes and tags in your CRM so any agent can pick up the conversation later.

| Pro tip: Use tags in CallHub to categorize leads by source (e.g., aggregator, bank, embedded partner), so you can compare close rates and adjust your channel investments over time. |

Before you begin

Not all distribution channels work for all companies. Therefore, it is important that you identify the ones that can aid your success. No matter which channel you select, it needs to align with your organization’s mission as well as business goals.

The method you choose must also be customer-centric. Do customers feel at ease when your agents reach out to them? Do they prefer one method of communication over the other? Do they want someone to talk them through the process, or do they want a hassle-free online experience?

When choosing an insurance distribution method, keep your customer at the center of your strategy development process and choose what uniquely suits you.

If you want to accelerate that journey, consider using CallHub to coordinate outbound calling, texting, and follow-up across all your insurance distribution channels, while staying aligned with TCPA, CASL, GDPR, and Spam Act requirements

FAQs on Insurance Distribution Channels

1. What are insurance distribution channels?

Insurance distribution channels are the ways insurers sell and deliver policies to customers, either directly or through intermediaries.

2. What are the four types of insurance distribution channels?

The four main types are:

- Agents

- Brokers

- Direct-to-consumer (online or call centers)

- Bancassurance & partnerships

3. What are the main insurance distribution channels?

Common channels include agents, brokers, direct online platforms, banks, digital marketplaces, and corporate or affinity partners.

4. What are insurance distribution companies?

Insurance distribution companies are intermediaries—such as brokers, aggregators, and insurtech platforms—that sell and manage insurance products for insurers.

Featured Image Source: canva.com