Table of Contents

Surveys are extremely useful weapons in an organization’s arsenal. It’s the only way to get honest customer feedback and insights that you can use to make major decisions.

Don’t believe me? Just take a look at Apple!

The Apple iPhone 6 models were designed to have a larger screen size, much larger than their predecessors.

This decision was based on surveys conducted by the “Apple Customer Pulse” which is an online community catering to the needs of the consumer by analyzing their feedback.

When Apple noticed an increasing number of people wanting larger phone screen sizes, they tweaked their product to suit their consumer’s needs. This practice has helped them dominate the mobile market for years on end now.

But think about this, what if Apple didn’t have such an engaged community to provide them with honest feedback? Do you think they would have had such success based on assumptions?

Obviously, No!

And this is a major challenge with surveys. The average survey response rates range from 5% to 30%. The number is at the lower end of this scale for small and medium businesses with little in-person contact and is higher for larger, more well-known brands.

This low response rate is generally not enough to give solid insights to make any significant decisions.

So how to get people to take a survey and provide you with valuable feedback? In this post, we’ll go over some strategies to help you with that.

How to find survey respondents?

Before you solve the mystery of how to get people to take a survey, you need to understand where to find the suitable people to take a survey. Here are a few areas where you can find respondents for your surveys.

1. Your existing list

Before you go out searching for survey respondents, look into your own database. Your database probably has a horde of email subscribers, blog subscribers, people who accessed your gated content, existing customers, etc.

Their existing relationship with you makes them your most relevant prospects because:

- It’s easier to approach them (since they are already engaged with you).

- Their experience with your product/service allows you to ask them questions specific to it. For example, a mobile phone company can ask people specifically what they want to change in their product or what they would like to see in it.

2. Social media

Half the world now uses social media, literally. So, finding prospects to fill out your survey on social channels wouldn’t be tough. You only have to create a post with a link to the survey form and share it with your network. You can request people to share it forward too.

The advantages with distributing your surveys over social media are that:

- You are not limited to respondents by geography. Your surveys can reach across geographies, depending on where you need data from. .

- It’s highly likely that people will share your surveys with their network because of how easy it is on social media (you just have to click a button). This, in turn, amplifies your reach.

You can further augment your reach on social media by leveraging ads to distribute your survey. Promote the post that you created and it will be shown to the audience that you choose. Here’s an example of how it looks:

3. Partnerships

If you don’t have a very large list of your own or an engaged audience on social media, you can form a partnership and target another organization’s audience.

You will have to reach out to a business that fulfills the following criteria:

- Has a large list of existing users or a highly engaged social audience.

- Complements your business so there is no conflict of interest. For example, a paper cup supplier company could partner with a coffee place. Moreover, no one’s stopping you to partner with your competitors too. Just do it at your own risk!

- Is interested in getting the same, or similar insights that you are looking for. That makes it a mutually beneficial partnership that they would not refuse.

When partnering with an organization, you will have to divide the tasks of surveying. One party could handle creating the survey and analyzing the data whereas the other could take care of distributing it to the right audience.

4. Panel respondents

Panel respondents are people who are chosen to fill out a survey. They are chosen from a pool of people who have signed up to respond to such market research surveys.

There are a number of such services like CheckMarket and Alchemer that people sign up to and can provide you with the respondents instantly.

If you go opt for panel respondents, the advantages are that:

- You can get a tailored list of participants quite quickly.

- These participants have signed up to provide companies like you with insights so they will most likely complete surveys and provide honest feedback.

The only drawback with it is that these lists can be expensive. Based on the kind of audience you are looking for, you can be charged up to $20 per participant.

5. In-person

This is probably the easiest way to find people to take a survey, but the process requires effort.

If you have a clear idea of who your target audience is, figure out where you are most likely to find them and head out to meet them face to face. For example, if you want to survey pet owners, head out to a park on a holiday and you’re bound to find some.

All you need is a tablet or paper to take down their responses and you’re good.

The benefit with in-person surveys is that:

- It has a high response rate. Since the effort that respondents have to put in is very less (they just have to talk while you note everything down), the likelihood of them taking the survey is very high.

- You can ask open ended questions and get more detailed responses from people. Again, since they aren’t putting in any effort, it’s a low-barrier ask for them that they would not mind obliging to.

Keep in mind that for this, you will need a lot of volunteers/employees to help you out. Especially if you wish to survey a large sample size.

Related Reading: How To Conduct A Community Survey Successfully? (With Best Practices)

How to get people to take a survey?

Once you find prospective survey respondents, the next thing you have to think about is how to get them to take a survey.

Here are a few strategies that you can leverage to get them to fill out your survey sincerely.

1. Explain the survey’s importance with the right messaging

If people are not sure what the purpose of the survey is, they are not likely to put in their time and effort in it.

The messaging that accompanies the survey is the first thing people notice and it’s crucial for you to make it compelling enough for people to click on the call-to-action.

Here are a few ways you can make it compelling:

- Highlight the importance of the survey– Explain why you need the insights and how you plan to utilize the insights. You can even connect it to how this data will help you improve your product/service.

- Use customer-centric language– Highlight the fact that you value their opinion and just can’t do without it. Make the respondents feel special and they will return the favor by giving you what you need.

- Clearly mention how long the survey is– Be specific about how much time it will take for them to fill out the survey so they know what to expect. Without a specific time commitment required, you risk people dropping off if it gets too long.

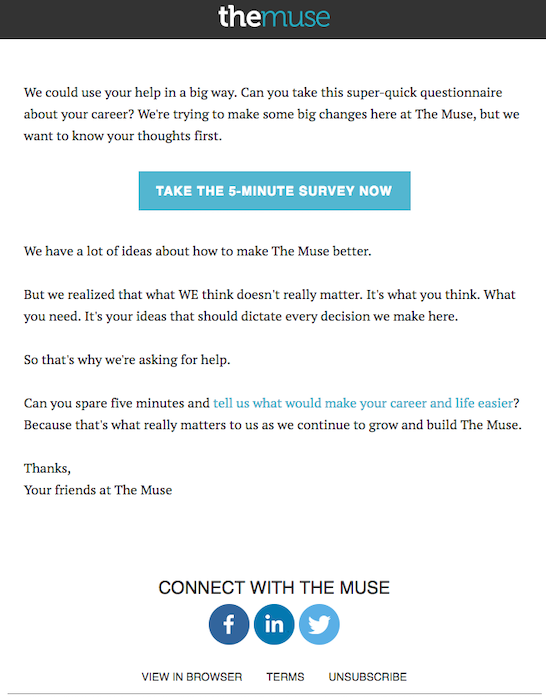

Here’s an example of an email survey sent to an existing customer. Notice how their messaging seamlessly includes all the elements that I pointed above.

2. Keep the survey short

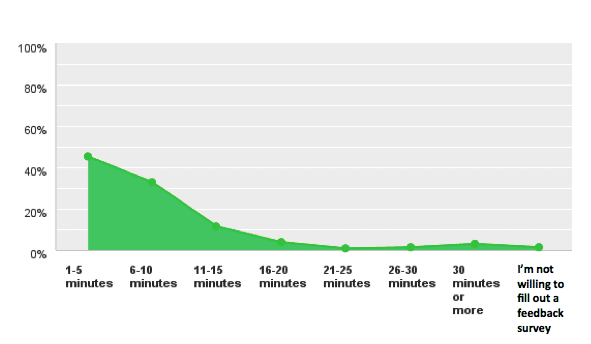

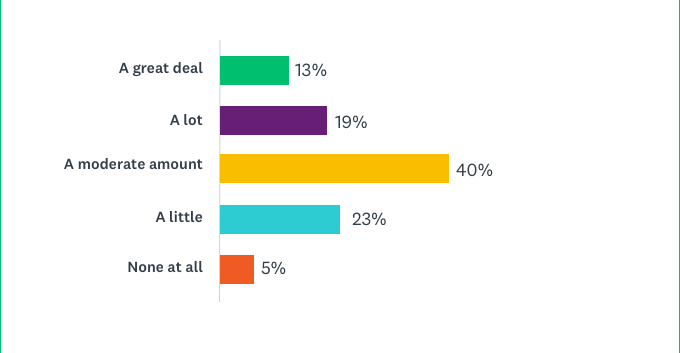

People don’t like putting in too much time when filling out surveys. Anything above 15 minutes is going to drastically reduce their willingness to respond to it. Here’s a chart that shows the proportion of willingness to fill a survey as compared to the time it takes:

As you see, there’s a steep decline as the time increases. While you still may get some responses for longer surveys, the number may not be as extensive as the desired sample size.

Therefore, when designing a survey, try to keep it as short as possible. Generally, there are two ways to do this:

- Design a survey with a few questions– The fewer the questions, the lesser the time it takes to complete.

- Leverage close ended questions– These take less time to answer so even if you have a “lot” of questions to ask, it shouldn’t take too long.

3. Have a multichannel approach to distribute your survey

Did you think sending your survey over email was enough? Or just putting out one post on social media would get you enough responses?

Obviously, not! If you want to get more people to take your survey, you have to be all over. There are two reasons why:

- You never know what channel your prospective respondents are most active on. Some may tend to scroll past posts on social media but carefully go through each email while some may pay more attention to social posts.

To avoid being ignored by any of them, it’s best to be everywhere to get their attention.

- If people come across your post/email/text when they are busy, they are likely to put it off for later and then forget about it. But, being in front of them on multiple channels will serve as a reminder which will push them to take the survey at some point.

4. Offer incentives

Let me get into a little psychology here to explain why this works.

The behavioral theory of motivation suggests people are motivated by a drive for incentives. Incentives are positive reinforcements that encourage them to do you a favor (in this case, filling out your survey).

At least 34% of people state that they fill out surveys for the reward.

But don’t worry about your data being corrupted by them. Their motivation may be questionable but 94% of them say that they give honest answers most often.

When choosing an incentive, make sure that it’s something relevant for the audience. For example, a discount coupon for your existing customers.

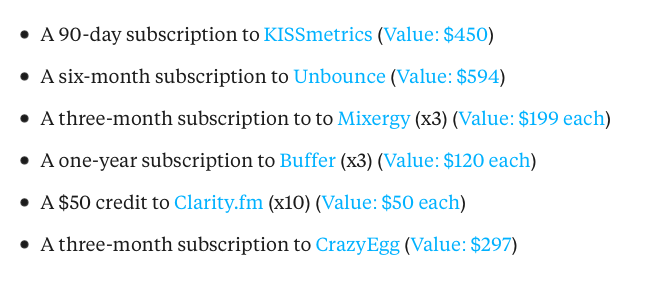

Groove, a customer service platform, offered free subscriptions to valuable tools as prizes. All people had to do was to take a survey and stand a chance to win. This strategy got them over 1,500 responses. Here’s a list of some of their prizes:

5. Follow-up with all survey respondents

You will be shocked to know that only 32% of survey respondents believe that companies pay attention to their feedback.

Their feedback not being taken seriously puts respondents off and they may not be open to filling out a survey again for you. Even if they do, they may not give you honest answers and just brush it off quickly for the reward.

These respondents are your most engaged audience for surveys, don’t let them fall out like that. Avoid this by making sure you:

- Follow-up with them immediately after they take the survey and thank them for their time.

- Keep them in the loop about the findings from the survey. You can create a report and publish it on your website and social media too.

- Let people know what changes you are implementing based on these findings.

- Lastly, don’t forget to follow up with prospects who didn’t respond. Send them a reminder (like a text reminder) asking them to take the survey.

These methods will help you motivate a large number of prospects to take a survey and provide you with honest and valuable insights.

But motivating people to take a survey is the latter half of the battle. To get to that point, you have to be able to reach out to them through the right channels. Check out this post on Survey distribution to know about the most popular channels of distribution to help you put your survey in front of the right people.

Featured image source: Mentatdgt