Table of Contents

Let’s exemplify the importance of a TCPA compliance guide for debt collection with the interesting case of Ramsey v. Receivables Performance Mgmt., LLC. (debtor vs. debt collection agency).

The debtor (Ramsey) owed a creditor some money but didn’t want to receive collection calls. So, he sends a letter revoking his consent. The creditor, regardless, sends his account details to the debt collection agency (Receivables Performance Mgmt LLC).

The agency goes on to do its job and makes a robocall to the debtor (thinking that he has given his consent) in an attempt to collect the owed amount.

And that’s where things take a turn for the worst. The debtor sues, and the agency ends up paying $122,000 to the debtor. Read that again!

When it comes to TCPA and debt collections, assumptions can leave you broke, quite literally.

But not to worry. This TCPA compliance guide for debt collection will guide you through all the key laws and tips to maintain compliance while still getting the job done.

Does TCPA apply to debt collection calls?

First, let’s understand what TCPA compliance is and why this question often arises.

The Telephone Consumer Protection Act (TCPA) is the primary federal law governing telephone solicitations. It regulates telemarketing calls, auto-dialed calls, pre-recorded calls, text messages, and unsolicited faxes. It also is the authority to create the National Do-Not-Call List, a list that people can opt into if they don’t wish to receive any telemarketing calls.

The implementation of TCPA laws is overseen by the Federal Communications Commission (FCC).

The TCPA was created in response to concerns about telemarketing and the poor practices followed by organizations that became a nuisance for citizens.

But why does the debt collection industry feel that TCPA might not be applicable to them? There are two reasons for that:

- Debt collection calls are not telemarketing calls: Collection calls are not made to market any product but to collect what is owed to the agency by the debtor.

- Varying court rulings: When the TCPA regulations came into effect, there was no mention of debt collection calls. They were added to the list later. But in 2015, the FCC issued a rule that collection calls for government-backed debts were exempt from the TCPA. However, in 2019, this exemption was scrapped off. So the confusion among debt collectors is not surprising.

Coming back to the question, does TCPA apply to debt collection calls?

The short answer is Yes!

However, since debt collection calls are not telemarketing calls, some rules of the TCPA may not apply to them. For example, debt collectors can make calls to people who are listed in the National DNC registry, but telemarketers cannot.

But, most rules, like needing consent to auto-dial cell phones, are applicable to debt collection calls too.

It’s best to follow the TCPA debt collection laws no matter what. This safeguards you from cases being filed against you on the grounds of technicalities.

TCPA debt collection laws you need to follow

Coming to the most crucial part of the TCPA compliance guide for debt collection, here are the outbound calling laws that you need to follow to maintain compliance.

1. State-wise calling time

As per the TCPA compliance regulations, telemarketers (and debt collectors) can make calls between 8:00 am and 9:00 pm.

But a key point to note here is that these time restrictions are different for different states. The 8:00 am to 9:00 pm is just a guideline laid out by the FCC, but states have the power to decide whether they wish to stick to this range or a lesser one.

For example, in the State of Massachusetts, you can only make calls between 8:00 am and 8:00 pm (and not 9:00 pm).

Keep in mind that this time is as per the recipients’ local time. So if you’re running operations that are spread across the country, make sure that your calling hours coincide with the debtor’s local time.

You can refer to this sheet to know about the State by state calling time restrictions.

How can you stay compliant?

Well, the answer is simple, don’t call after 9:00 pm or before 8:00 am. But I know that this could be quite difficult to keep up with, given that you’ll have to look at your watch every time (at least when you start your day or near the end) before making a call. Plus, if your operations are spread across time zones, the effort to calculate the time before making calls just adds to the complexity.

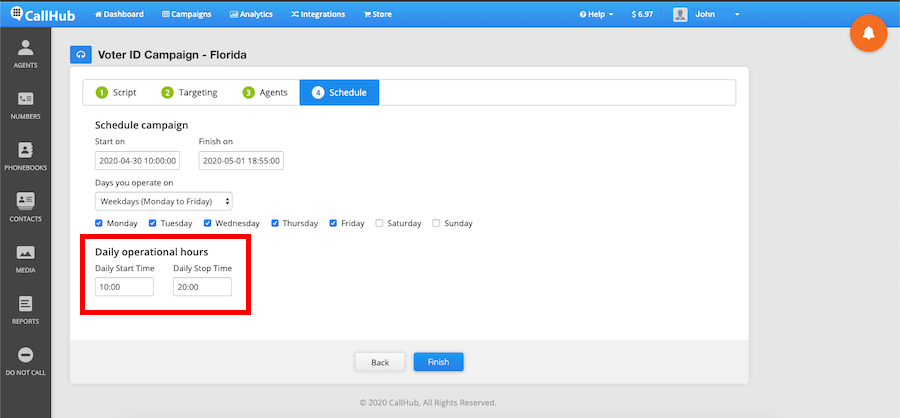

A more efficient way to stay compliant would be to schedule the daily operational hours of your calling campaigns in your call center solution. When setting up a calling campaign on CallHub, you can set this before the campaign commences.

The campaign automatically remains inactive outside of these hours, and agents won’t be at the risk of breaching this TCPA rule.

Pro tip: When setting this schedule, keep some buffer in the daily operational hours. For example, instead of setting up a campaign from 8:00 am to 9:00 pm, set it from 9:00 am to 7:00 am. This will ensure you maintain compliance in case a call goes on for too long.

2. Calling people on the DNC list

A Do-Not-Call list (DNC) or Do-Not-Call registry is a list of personal phone numbers that are off-limits to telemarketers. The FCC maintains a national registry of these phone numbers that people can register to for free if they don’t wish to receive these calls.

But, debt collection calls are not telemarketing calls which means that they can call people even listed on the National DNC list.

However, if the debtor explicitly asks not to be called, then the collection agency has to uphold this request, no matter what.

The request to revoke consent can be made either verbally (during a call) or in written via direct mail to the debt collector. In either case, you will have to rely on other ways like letters or emails to get in touch with these debtors.

How can you stay compliant?

The only way to ensure that you don’t call people who revoked their consent is by maintaining a DNC list of your own. There are two ways to do this:

- Maintain a sheet and keep adding the numbers of the debtors who asked you not to call them. The next time you make a call, just cross-check whether the number you’re dialing is in the sheet.

- Use a call center solution that allows you to maintain a DNC list. A tool will help you automate the process by allowing you to add numbers to the DNC list during calls and won’t dial it even in future campaigns unless you manually remove the number from the list. This is a little more efficient and easier than maintaining a spreadsheet. Don’t you think?

If you’re going for the software option, just make sure to select a tool that makes it easy to import and export your DNC list and use it across campaigns.

So, if you upload a new list of numbers to call and a DNC number is mistakenly included in it, the software will still ensure that it is not called.

3. Calling people at work

Another important TCPA debt collection law that agencies often overlook is calling people on their work phones.

While it isn’t illegal to call debtors at work, it becomes unethical if:

- The debtor is not allowed to take personal calls at work. The debtor will have to let you know about this, though, and then you can’t call them the next time.

- The workplace, by nature, is inconvenient or unusual to take debt collection calls. Examples of these places include restaurants, funeral homes, schools, and hospitals. Again the debtor will have to let you know if you aren’t aware of their occupation. However, if you are, it’s best to avoid calling these places of work.

How to stay compliant?

List segmentation can come to your rescue here. When you start making collection calls to a list, filter out the work phone numbers and add them to your DNC list.

But, if you aren’t aware that the number is that of a work phone and you have a doubt that it is, then you can do two things:

- Hope that the debtor lets you know that this is a work phone and you can’t make calls to it. If they do, tag the number accordingly and move it to your DNC list.

- Add a brief line in your debt collection call script to confirm if you have the debtor’s consent to call them at work. This would be a much safer option because you won’t have to rely on the proactiveness of the debtor.

4. Identifying the caller over voicemail

It’s common knowledge that at the beginning of any business call, the caller has to clearly identify themselves, the organization, and the reason for the call.

While it’s easy to ensure this when a call is picked up, the real trouble begins when your call is sent to voicemail.

Why?

Because one of the FDCPA laws states that you cannot disclose any information about the debt to any third-party, and you can’t be sure if the voicemail that you leave is listened to by the debtor or someone else. So now you’re in a pickle.

How to stay compliant?

While following this TCPA debt collection regulation may seem complicated, it actually is not. All you have to do is make sure that you craft the perfect voicemail message script for all your callers.

When crafting the script, you have to ensure that:

- You don’t disclose any information regarding the debt.

- You leave all the relevant information required for the debtor to identify you.

Here’s a script sample that you can use for your voicemail message.

This call is for [Debtor name].

If we have reached the wrong number for this person, please return our call at (phone number), and we will remove this number from our records.

If this is not [Debtor name] please hang up or disconnect now.

If this is [Debtor name] please hold, there will now be a 5-second pause to allow you to avoid the disclosure of this message to other individuals.

[5-second pause]

This call is from [Caller name] from [Organization name], a professional debt collector. Please return my call to [Phone number] for an important message. Again the telephone number is [Phone number].

Thank you.

5. Calling mobile phones

The TCPA compliance guide for debt collection would be incomplete without anything on calls to mobile phones. After all, the number of landlines is decreasing and are replaced by mobile phones.

TCPA debt collection laws dictate that you cannot make calls to a mobile phone using an auto-dialer without prior consent.

The FCC generally accepts that a consumer has given their consent to be contacted on their mobile phone if they provide their number when asking for a loan. However, keep in mind that the debtor can revoke their consent verbally or in writing at any point in time later.

How to stay compliant?

The solution is in the regulation itself; get the debtor’s number during the transaction. That is generally enough to legally allow you to make calls to cell phones.

However, you can foolproof the consent by including a statement in the agreement, stating that you will make debt collection calls to the given mobile number and get debtors to agree to it.

Another (and I would say more efficient) workaround is to use a TCPA compliant dialer like CallHub’s FastClick Dialer. This dialer allows you to call phone numbers while maintaining compliance.

What is a FastClick Dialer, and how does it maintain compliance?

The FastClick Dialer is a dialer that uses human intervention to initiate calls, and this is what makes all the difference.

Let me explain how.

The FCC defines an Automated Telephone Dialing System as “equipment that has the capacity to:

- Store or produce numbers to be called, using a random or sequential number generator, and

- Dial such numbers.

However, in a FastClick Dialer, a dedicated agent has to manually queue the numbers that are to be called and dial them by clicking a button.

Since the system doesn’t use a random or sequential number generator to queue these numbers, it maintains compliance.

Plus, since the dedicated agent is not manually dialing the numbers, it also helps you maintain a high calling speed and go through huge contact lists in no time.

Therefore, it helps you get through large lists of calls without having to worry about breaking the law.

These were the TCPA regulations that you need to follow to maintain compliance when making debt collection calls.

While I have covered all the regulations in this TCPA compliance guide for debt collection calls, I recommend you bookmark this page of the FCC website to stay updated with telemarketing amendments.

If you’re ever in doubt, it’s also recommended to contact a knowledgeable attorney to counsel you on your current practices and changes to the regulations.

But for now, following the above steps to maintain compliance can ensure you don’t get caught in a tricky situation.

Featured image source: Andrea Piacquadio