Table of Contents

A gift program facilitates a relationship with supporters, guiding them to fund specific causes, projects, or nonprofit campaigns. While corporate gift matching and grants contribute significantly to a nonprofit’s finances, gifts programs for grassroots fundraising also play a crucial role in sustaining long-term support.

Through grassroots fundraising, nonprofits and advocacy groups ensure

- A strong grassroots supporter base to validate their campaigns.

- An in-flow of funds from highly engaged supporters. This engagement indicates a higher level of involvement.

- Validation and trust-building with corporates who will contribute only if there is continual and robust support from the masses.

Through a gift program, not-for-profit organizations can ensure a planned, organized and calculated means of raising donations from the masses.

This blog covers some practical ways of using gift programs for grassroots fundraising.

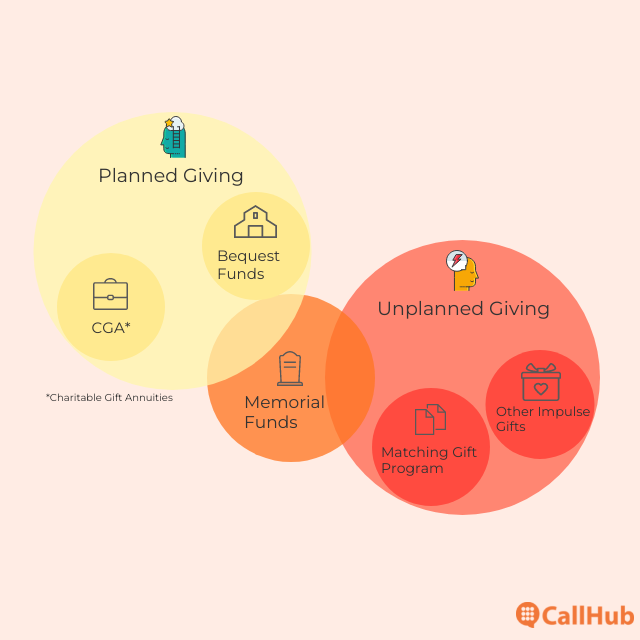

Types of gift programs for grassroots fundraising

Gift programs typically aim for major gifts or donations. On the other hand, grassroots fundraising can focus on small contributions from a more extensive set of people. These types of charitable giving can sound contradictory.

However, planning, tributes, and installment payments bridge the gap between the two. Here we look at some gift programs you can adopt for grassroots fundraising.

- Planned giving

- Memorial funds

- Bequest programs

- Charitable gift annuities

- Matching gift programs.

Let’s look at each in more detail.

Planned giving

planned gifts are significant contributions to a charitable organization as part of the donor’s financial or estate plan. These gifts can be given during the donor’s lifetime or after death.

One of the primary reasons people don’t give is financial incapability, and 42% of people cited this.

This shows us that people are willing to contribute to causes but are held back due to monetary obstacles. Planned giving works its way around this and gets interested people planning about their contributions to causes.

How?

A gifts programs for grassroots fundraising that focuses on planned giving is suitable for grassroots fundraising because it can reposition charitable giving as part of a person’s monthly/annual plan rather than an impulse gift.

In addition,

- It helps nonprofits acquire donations to support them in the long term.

- Meanwhile, they can nudge these donors for smaller donations for different campaigns.

- It lets interested donors contribute even if they don’t have adequate financial resources at present.

Steps to adopting a planned giving gift program:

- Identify the types of planned giving gifts your organization can and wants to accept. Create a roadmap to fit these major gifts into your long-term planning.

- Finalize in-house or outsourced specialists who will work with donors in the paperwork, road mapping, and legal processes.

- Allocate technical resources.

- Build a donor persona for focused and more accurate targeting.

- Start marketing and promotions at a grassroots level to let prospects know about this gift program.

- Initiate communications with the current supporters and contacts to tell them how to donate a deferred gift.

- Start assigning interested people in a nurturing flow. This will include educating them and leading them step-by-step until they complete all formalities.

- Make public acknowledgments of registered donors to gather social proof and use that as marketing material.

You May Also Like: How to Ask for a Major Gift: 3 Fundraising Major Gift Ask Sample Scripts

Memorial funds

People often commemorate their deceased beloved(s) with a generous donation to a charity. The contribution can be with

- Monetary funds the deceased left behind.

- A portion of their estate, or

- By raising funds in the name of the passed person and dedicated to a charitable cause.

The last type of memorial funds is especially relevant to grassroots fundraising. It brings together people in the form of peer-to-peer fundraising and ensures a higher total sum to your nonprofit.

Steps to adopting a memorial fund for gift programs:

Accepting a donation for a memorial fund would follow the same process as getting any other contribution. The difference in steps is about marketing this gift program and actions you must take after receiving the funds.

- Create tribute forms with your fundraising tools (such as Donorbox). These forms will let contributors dedicate the funds to another person.

- Let people know of the memorial giving option in all your communications. This includes promotional posts and personal communications with current supporters.

- Add a communication flow to respond to all people contributing to the memorial fund.

- Send personal letters/emails to those who started the fund. They are most likely to be close relatives or friends of the deceased, and a condolence message or a tribute message would go a long way.

- Publish the deceased’s name in your newsletter and promotional materials (with prior permission from the next of kin).

- Make arrangements to update your data files, so future communications are directed to the next of kin and not to the deceased.

Bequest programs

A bequest program promises a share of the estate or a specific cash amount to a charity after a donor’s death. The difference between this and planned giving is that planned giving can be a promise of a donation after a set period or after a person’s death. In effect, a bequest gift program is a subset of planned giving.

Bequest gifts (also known as legacy gifts) are the most popular type of planned giving, claiming more than 8% of the planned gifts to charities. Thus, they promise to be a practical part of your gift programs for grassroots fundraising.

Steps to adopting a bequest fund for gift programs:

- Form a team to oversee the legalities, finances, and management of the bequest gift programs. This team will form the foundation of all future fundraising efforts of this kind.

- Segment the bequest gifts you can accept. Such segmentation will allow for a more streamlined and organized process when you start receiving donations. For instance, cash payment and an estate transfer will include vastly different legalities. You can categorize donors by the size and type of legacy gifts they pledge to you.

- Segment your target audience for more effective messaging during marketing and promotions.

- Dig through your database for files on current contacts and study who could be good prospects for your bequest programs. Contact them personally to share information about your legacy programs.

- Set up systems (including the legal team, IT department, marketing teams, etc.) to establish the foundations of your legacy programs. Deploy marketing material once all the processes are in order.

Charitable gift annuities

Charitable gift annuities (CGA) are irrevocable gifts given to a nonprofit in exchange for fixed-income payments. These annuities are in the form of cash or securities and provide tax benefits.

A donor promises a fixed and recurring amount to a nonprofit, which the nonprofit invests on their behalf. The profits go back to the donor, and when the donor passes away, the entire amount, collected as an investment throughout this period, goes to the charitable organization.

Charitable gift annuities are a great way to raise funds from the grassroots because it asks for a relatively small amount but makes the cash-inflow recurring. They also benefit the donor with tax reductions.

You can go a step farther and set up pooled income funds. Pooled-income funds have a similar use case, but instead of investment on behalf of one person, the funds of two or more donors are pooled together for a larger investment. The per-head cost remains the same, but the overall investment and returns are much more significant.

Things to consider and study before settling up a CGA for your organization:

- Understand the longevity of your organization, finances, and donor prospects. Basically, are you equipped to support a program that will give results only after several years? And are your supporters open to giving you such a commitment?

- Many states require $300,000 to $500,000 in unrestricted assets for a nonprofit organization to adopt and issue CGAs. Do you fall in this category?

- Do you hold the financial and legal resources to issue CGAs?

- Do you have adequate staffers, training programs, and a 3-5 year development program to issue CGAs?

Remember that CGAs are a very delicate gift program to adopt. The above points would only help you begin considering this program for grassroots fundraising. Refer to the American Council of Gift Annuities’s guide for a more thorough look at the requirements and fundamentals of CGA.

Matching gift program

A matching gift program is one where an employer matches the donation made by their employees to a registered nonprofit. These gift programs are great for grassroots fundraising because donors can still pay a small amount while charities get a relatively large amount in their kitty. Matching gifts can also encourage other employees of the company to follow the first and donate to your organization.

While charities themselves need not do much for a matching gift program, your donors need to take particular steps. Raise awareness among your supporters to ensure they get matching donations from their company.

Steps your donor takes to deploy a matching gift program:

- Ensure their company offers matching gifts and understand the amount they match (e.g., some companies may match the donation 1:1 while others may match up to 2 dollars for every dollar donated by the employee).

- Donate to a nonprofit and collect the receipt.

- Request a matching gift from the employer and submit the donation proof.

- After verifying the donation, the employer will contact your organization to confirm the donation. They typically have a set period when they submit the matched gifts (e.g., within 120 days of the donation).

Here is a list of top companies that offer gift matching programs. Dig through your contacts to see if any supporters are employed there and target them for donations specifying the matching gift program.

While you need not set up a matching gift program, you can follow some best practices to raise awareness and encourage your contacts to make donations under this gift program. Here are some:

- Add an option to match gifts on your donation page.

- Raise awareness about such programs, along with the list of employers in your target geography who offer such programs.

- Have dedicated landing pages on your website for matching gift programs.

- Add information about matching gifts in your communications and lead them to the dedicated landing page with a clear CTA.

Read more: 3 Ways to Market Matching Gifts for Your Nonprofit.

The way forward

Using gift programs for grassroots fundraising is a great idea to plan a part of your donation incomes in advance and ensure financial security.

This blog focused on the steps to take to adopt five such techniques. But to ensure you get the best results in your major fundraising efforts, you must adopt some industry-tested best practices. We’ve got you covered on that front. Read our guide, Major Gift Fundraising: 9 Best Practices You Can Implement Today.