Table of Contents

Selling insurance over the phone means using a structured, compliant, and conversation-led approach to connect with prospects, identify their needs, and guide them towards the right policy – without having to meet them in person. Whether you sell life insurance, health insurance, or auto insurance, the core principles remain the same.

The most effective agents combine the right tools (CRM, dialer, quoting software), a solid calling script, a pre-call preparation routine, and consistent follow-ups.

This guide will cover everything – from must-have tools to actionable frameworks and FAQs that will help you sell smarter and faster.

What are phone-based insurance sales?

Before you start making calls, let’s take a look at what you need at your disposal to start selling insurance over the phone. I’m dividing these requirements into two major categories to help you prioritize what to invest in, based on your budget: Phone-based insurance sales means selling insurance policies (health, life, auto, or home) directly to potential customers through telephone outreach, using a mix of technology and structured scripts, and a clearly defined sales process.

Unlike an in person meeting, the phone sales approach depends heavily on your tone, your ability to answer questions clearly, and your skill in building rapport quickly with your target audience.

Why focus on phone-based insurance sales?

Selling insurance over the phone is one of the most efficient and scalable methods for reaching today’s leads, and statistics clearly back this up:

- PwC highlights that assisted distribution models, where agents leverage digital tools, can reduce prospecting costs by up to 80% compared to traditional field sales.

- According to Sales Insight Lab, over 41% of sales reps still identify the phone as their highest-converting channel.

But keep in mind that success depends on having the right strategies, tools, and follow up processes in place.

Tools you need for selling insurance over the phone

These are the things and resources that are non-negotiable. For insurance sales, these include:

CRM (Customer Relationship Management software)

A CRM serves as the central depository for your data.

You may procure prospect/lead data from multiple sources, like marketing campaigns or purchased lists.

But, this whole reserve of data won’t do you much good if you can’t

- Organize your data with relevant identifiers.

- Filter out what you need for a particular interaction.

- Import or export data from third-party applications (like your calling software).

A CRM makes these tasks a breeze, that too without demanding any significant technical expertise. All of this data can be stored in your CRM and used in any way needed.

Calling software

If you’re going to sell insurance over the phone, a phone is quite an obvious requirement. But a normal phone won’t significantly reduce efforts or make your process efficient.

What you need is a comprehensive call center software that:

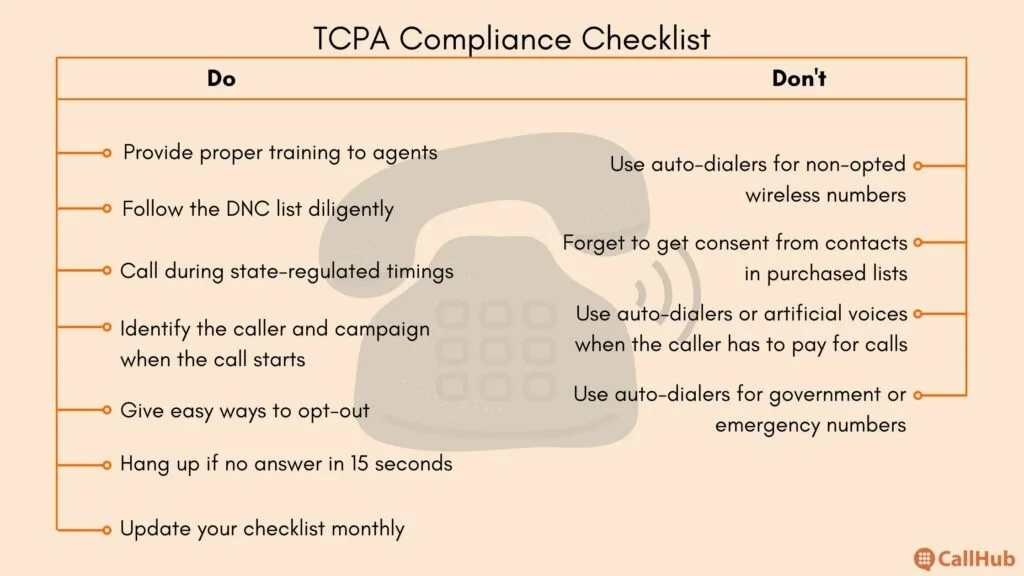

- Provides multiple inside sales dialer options, including a TCPA compliant dialer, allowing you to control the calling speed, which helps you save time and makes you more productive.

- Displays a calling script on the dashboard for your reference. It should also allow you to take notes during the call.

- Seamlessly syncs with your CRM, thereby allowing you to easily import the data you need for a call and export new data that you procured over the call.

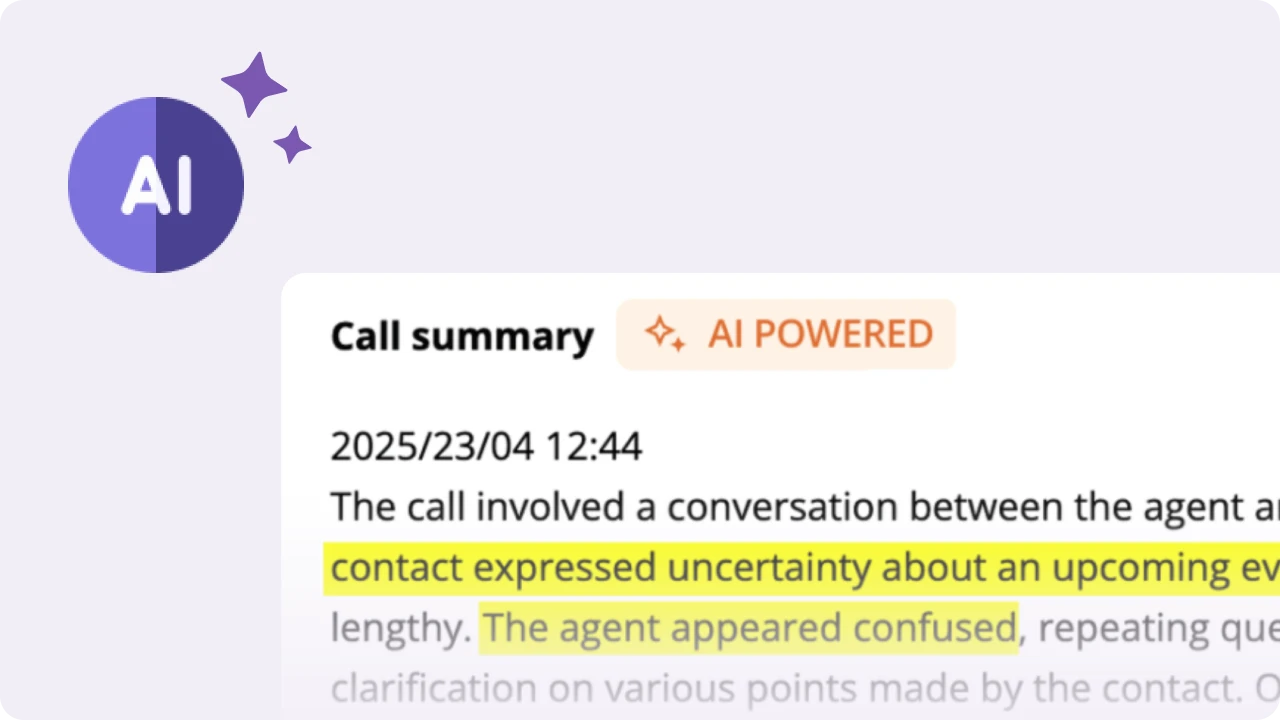

- Provides you with a comprehensive report with various metrics that help you analyze how the calls went and what needs to be improved.

- Allows you to schedule your campaign, so you don’t accidentally make calls outside of the calling hour limits set by the TCPA to maintain calling compliance.

Quoting software

This is especially beneficial for insurance brokers trying to sell insurance over the phone.

Quoting software allows you to compare prices from different carriers and suggest the best fit for your prospect.

The software helps you save time as you don’t have to manually go through each carrier’s website to know about their plans. Imagine the time your prospect would have to hold while you do this. So it improves your customer service too.

If you don’t currently use quoting software, you can look into Quotit and Ninja Quoter as options.

Calling script

Whether you’re an experienced caller or a fresher, a calling script is a handy resource that guides your conversation.

An insurance cold call script ensures that you:

- Don’t miss out on key details during the conversation. These could be questions you have to ask the prospect or details about the product you’re pitching.

- Have good comebacks for common objections, so the conversation doesn’t end prematurely.

- Are you aware of how to lead the conversation from the opening to the final pitch?

| Pro tip: If the prospect asks a specific question, raises a common objection, or shows high intent, use CallHub’s branching scripts to automatically route agents to the right response path so they always know what to say next. |

Read Also: Crafting Effective Cold Calling Scripts: Strategies & Tips

Field underwriting guides or questionnaires

This is exclusive for health insurance and life insurance sellers. The insurance companies themselves generally provide these guidelines.

These guidelines help you assess the prospect’s insurability by gathering critical information. Generally, this includes details of:

- Specific diseases and when they were contracted.

- Family history of diseases and hereditary conditions.

- Current and past occupation, etc.

These guidelines help you draft your script with all the essential questions you need to assess the prospect’s risk of being insured.

Read Also: Guide Call Center Agents to the Right Questions with Branching Scripts

How to Prepare for Selling Insurance Over the Phone

Preparation is what separates average results from consistently high close rates when selling insurance over the phone. Before you dial:

- Believe in your product:

Prospects can sense confidence and hard work through your tone.

- Practice your script:

Know it well enough to sound natural, not like you’re reading.

- Research each prospect:

Use CRM notes or public profiles to personalize your pitch and build rapport from the first minute.

- Choose the right time:

Use your calling software to identify the “good time” for each segment based on past connects.

Having everything ready – notes, script, quoting tool, and underwriting guides means you can stay present in the conversation instead of scrambling for information.

Crafting Scripts for Selling Insurance Over the Phone

Scripts are essential for selling insurance over the phone because they keep you compliant, consistent, and confident, especially under pressure. A strong insurance phone script will:

- Open with a short introduction

- Warm the prospect through small talk

- Deliver a clear, value-driven sales pitch

- Use open ended questions to uncover needs

- Build rapport by acknowledging their priorities and loved ones

- Transition smoothly into quoting and next steps

Treat your script as a guide, not a word-for-word speech. The best calls feel conversational, but still follow a proven structure.

Read Also: Sales Script Examples (and how to write one!) | CallHub

Best Times for Selling Insurance Over the Phone

Timing can make or break your results when selling insurance over the phone. Many agents see higher pickup and engagement rates:

- In the early morning (e.g., just after people start their day).

- In the late afternoon, before they fully switch off from “work mode.”

- On weekdays, avoid obvious family or meal times.

Track your own data in your calling software: which time blocks produce more live connects, longer conversations, and more follow-up appointments. Use that data to build calling blocks around your highest-performing windows.

Read Also: The Best Time To Cold Call In 2025

Handling Objections When Selling Insurance Over the Phone

Objections are a normal and even healthy part of selling insurance over the phone. They often mean the prospect is engaged but not yet convinced. A simple objection-handling framework is:

- Acknowledge: Show you’ve heard and respect their concern.

- Clarify: Ask a short question to understand what’s really behind it.

- Reframe: Connect your product back to their stated goals or fears.

- Support: Use a brief example, benefit, or comparison to reassure them.

- Confirm: Ask if that addresses their concern, and move to the next step.

Common objections like

“It’s too expensive,”

“I already have a plan,” or

“I need to think about it.”

should all have pre-written, practiced responses in your script so agents feel ready and calm.

Read Also: How to Write A Winning Telemarketing Script (2025 Guide)

Follow-Up Strategy After Selling Insurance Over the Phone

Most policies are not closed on the very first call, which makes follow-up a critical part of selling insurance over the phone. After each call:

- Tag the lead in your CRM by interest level (e.g., hot, warm, cold) and situation.

- Schedule specific next steps: a follow-up call, quote review, or document request.

- Send supporting materials like summaries, case studies, or testimonials that match their concerns.

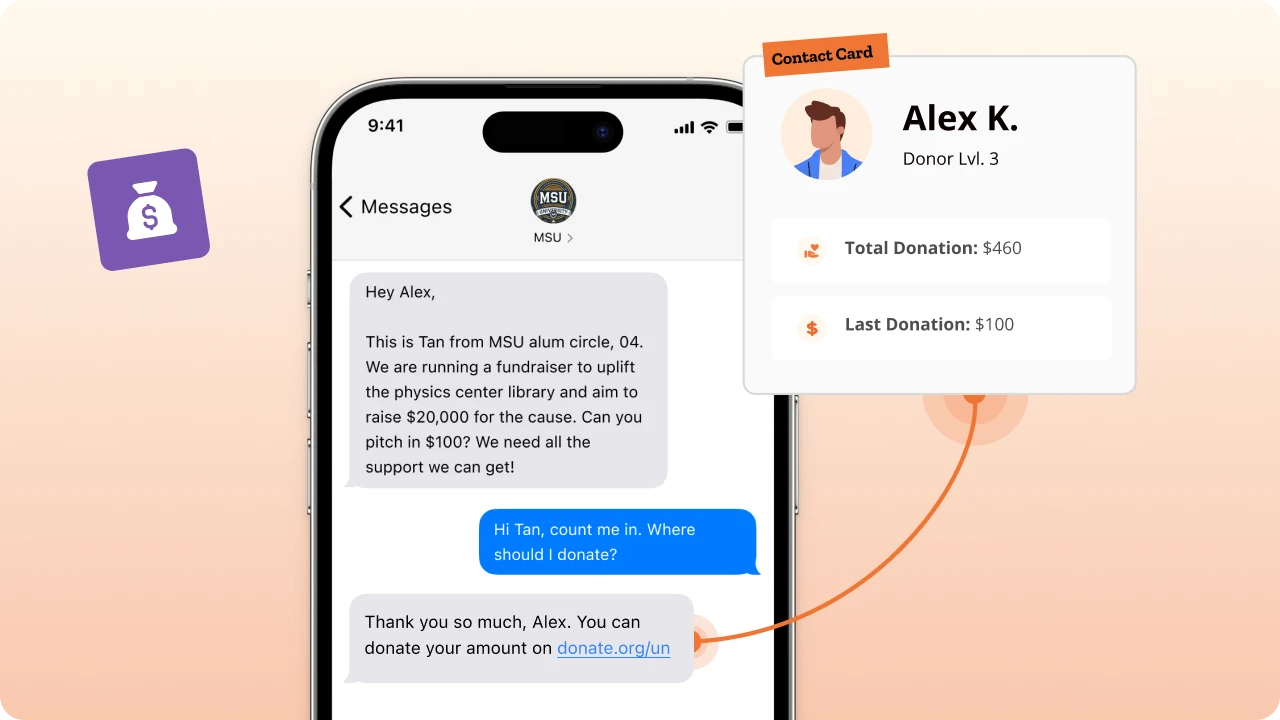

- Use CallHub as your multi-channel outreach for follow up email, SMS, and calls to gently stay top-of-mind without spamming.

Strong follow up processes turn good conversations into bound policies and create a repeatable engine for your pipeline.

Read Also: Proven Call Center Scheduling Software for Better Results

Legal and Compliance Basics for Selling Insurance Over the Phone

Legal compliance is non-negotiable when selling insurance over the phone. Agents must:

- Hold the appropriate licenses for the products and states where they sell.

- Respect calling regulations, including permitted calling hours and do-not-call rules.

- Obtain appropriate consent for calls and messages when required.

- Follow carrier and agency guidelines for disclosures and documentation.

Your calling software and CRM should help you stay compliant by managing consent, limiting call times, and recording necessary details.

Read Also: The Ultimate TCPA Compliance Checklist to Avoid Massive Fines

Moving forward with selling insurance over the phone

Selling insurance over the phone becomes far more effective when your scripts, tools, and follow-up are all working together. Start by refining your script, tightening your pre-call routine, and using your CRM and calling software to track every interaction.

Over time, small improvements in each stage of your process will stack into big gains in closed policies and commissions.

Ready to streamline selling insurance over the phone? Start a free trial of CallHub and see how much more you can close with smarter dialing, better scripts, and built‑in analytics

FAQ on selling insurance over the phone

How to Sell Life Insurance

You sell life insurance by identifying the prospect’s financial goals, understanding their family needs, and offering the right policy based on long-term protection.

Use open ended questions to uncover income, dependents, and future plans. Provide simple explanations, real examples, and clear comparisons.

Follow up consistently, since most life insurance sales require multiple touches. Using a CRM and compliant dialer like CallHub keeps your outreach organized and timely.

How to Sell Life Insurance Over the Phone (Script)

Start with a short introduction, state your reason for calling, and immediately show value (e.g., protecting loved ones or reducing premiums). Ask open ended questions about family size, income, and current coverage. Use active listening to identify gaps and build rapport. Present options in simple language, handle objections calmly, and confirm next steps. A good script includes:

Clear call-to-action

CallHub’s branching scripts help agents deliver the right response path automatically.

- Warm introduction

- Why you’re calling

- Qualification questions

- Needs-based explanation

- Policy options

- Objection handling

- Clear call-to-action

- CallHub’s branching scripts help agents deliver the right response path automatically.

How to Sell Insurance Over the Phone

Selling insurance over the phone requires a structured process: prepare your script, research the lead, call at the right time, ask needs-based questions, and listen actively.

Tailor your pitch to their lifestyle, budget, and concerns. Avoid jargon, build rapport, and guide them step-by-step through coverage options. After the call, follow up through SMS, calls, or email until the prospect is ready to decide. Using a CRM and a TCPA-compliant dialer of Callhub, improves speed, compliance, and consistency.

How to Sell Car Insurance Over the Phone

Selling car insurance starts with verifying the customer’s vehicle, driving habits, and current premium. Ask questions about usage, mileage, coverage limits, and pain points like high rates or poor service.

Highlight savings, bundling options, accident forgiveness, or added benefits. Keep explanations simple and provide clear side-by-side comparisons.

End by confirming their preferred coverage and guiding them toward the quote or application. Follow up if they’re not ready to commit.

How to Sell Health Insurance Over the Phone

To sell health insurance, begin by assessing the customer’s health needs, age, lifestyle, medications, and preferred doctors.

Ask questions that identify gaps in their current plan, such as deductibles or out-of-pocket limits. Explain coverage in simple terms and compare plans based on cost, benefits, and network.

Build trust by showing how each option fits their situation. Schedule follow ups for enrollment deadlines, and use automated workflows in tools like CallHub to stay connected.