A penalty of up to $5000 per campaign/fundraising event.

That’s what your nonprofit organization stands to face for not sending a donor acknowledgment letter. Needless to say, sending this legal document (required by the IRS) is quite important for all nonprofits.

But is that all it has to be?

Not at all.

Since it’s mandatory for you to send a donor acknowledgment letter, why not make the most out of it?

If crafted well, this interaction can help you extensively in retaining donors and building relationships (because it is a letter your donors can’t ignore reading).

That’s what we’ll be looking at in this article. How can you write a donor acknowledgment letter that’s quick to read but echoes endlessly? This article will guide you in crafting an impactful donor acknowledgment letter that not only fulfills legal requirements but also enhances donor relationships.

What is a donor acknowledgment letter?

A donor acknowledgment letter is a legal document given by tax-exempt nonprofit organizations to donors. The IRS requires these organizations (also known as 501(c)(3) organizations) to send a formal acknowledgment letter for any donation of more than $250.

Donors may use this letter as proof of their charitable contribution to claim a tax deduction.

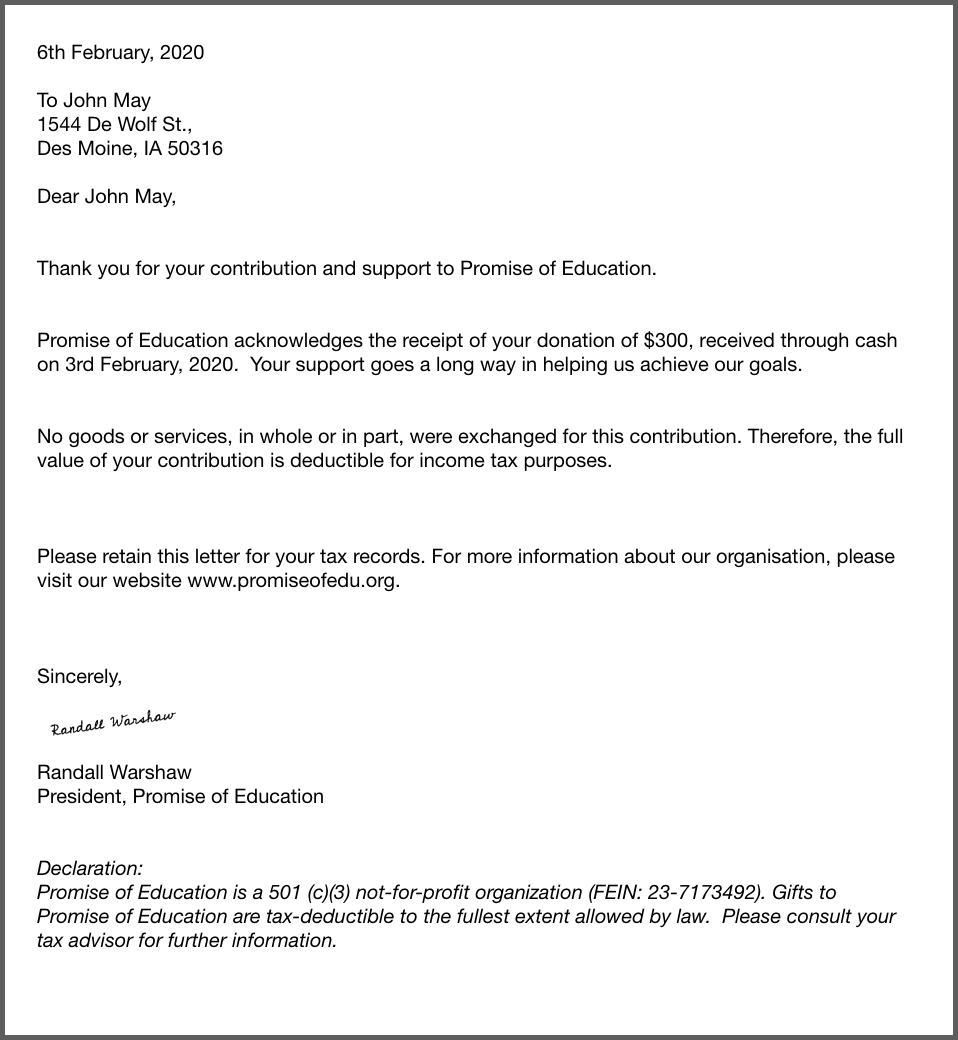

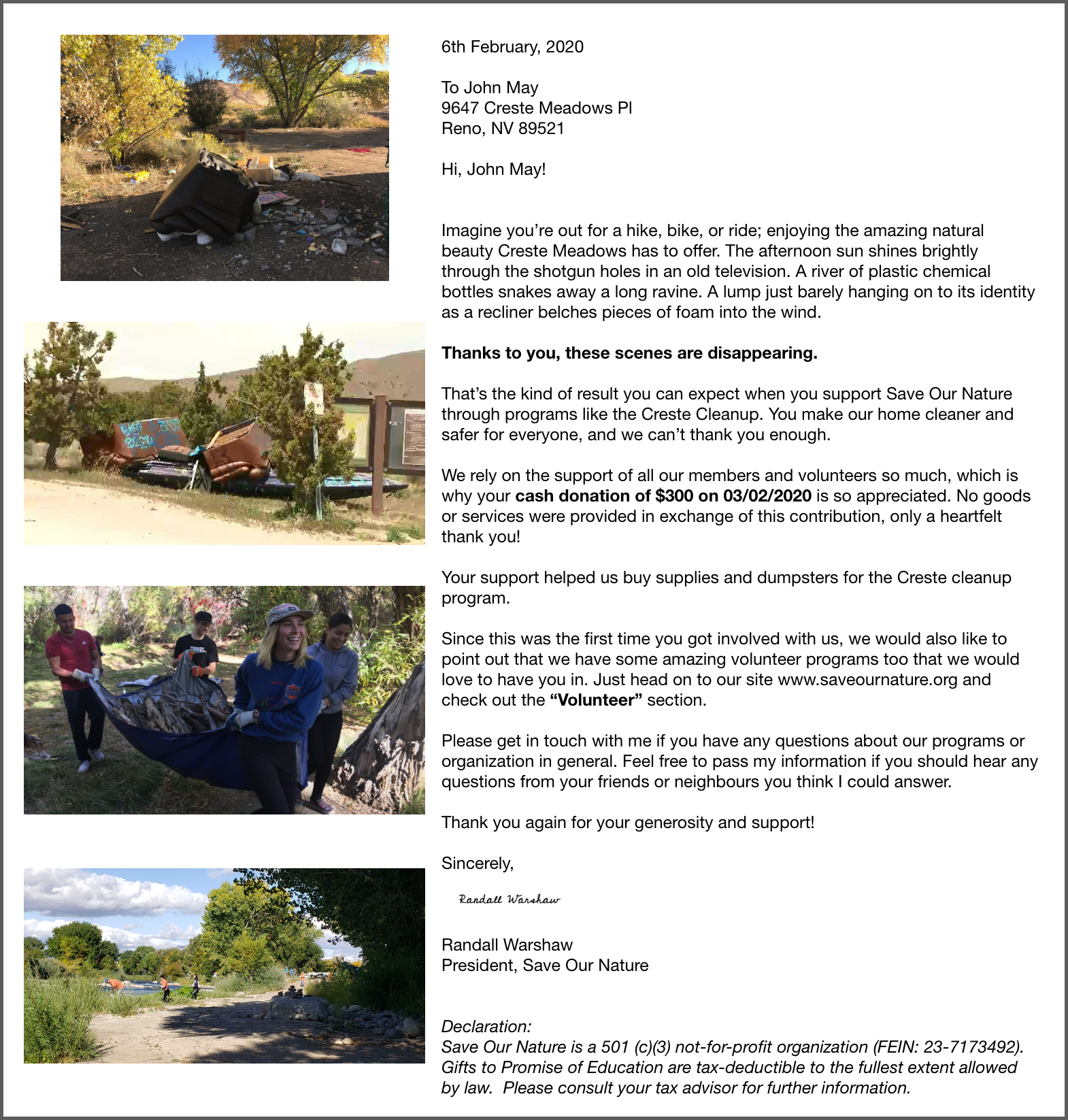

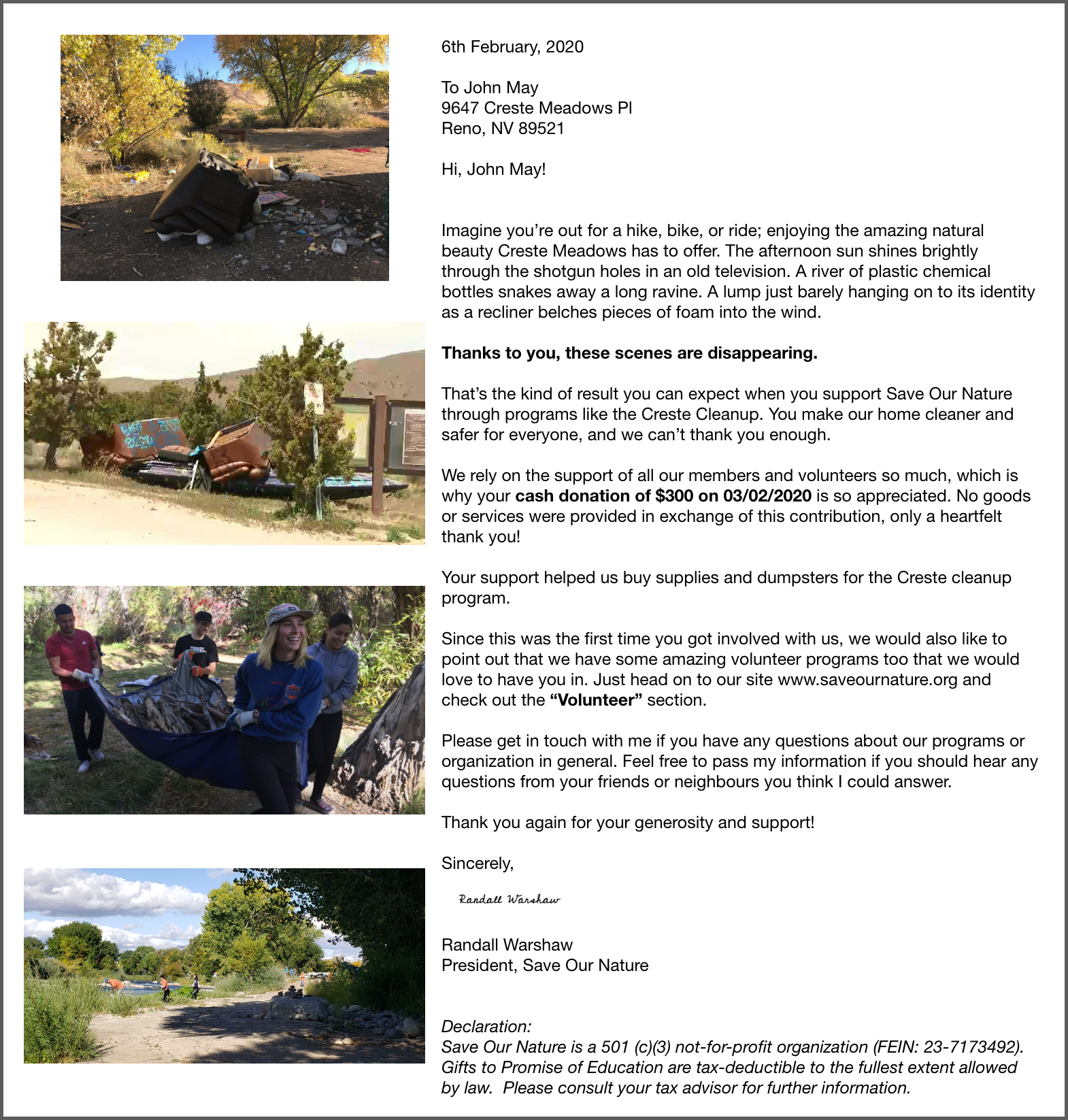

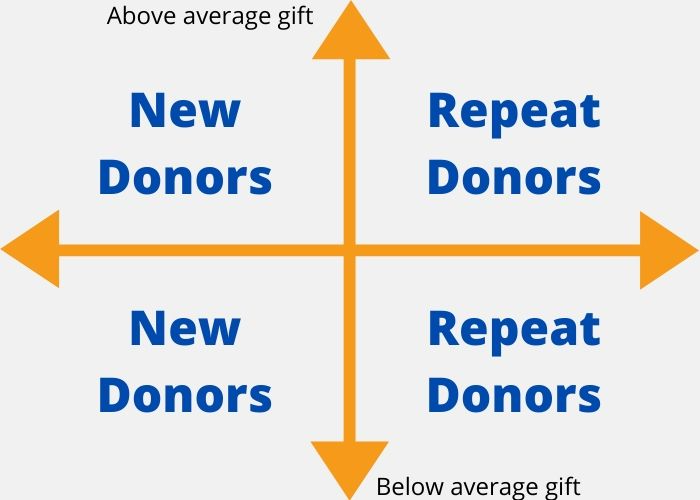

Here’s an example of a Donor Acknowledgment Letter for a cash contribution of $300.

Importance of donor acknowledgment letter

You might be wondering, “What tips would I need for such a straightforward letter?”

Well, if you think this is just a straightforward legal letter, think again!

The donor acknowledgment letter is an important touchpoint in a donor’s journey. This is a letter that donors actually read thoroughly (to ensure all legal requirements are in place). Moreover, understanding the strategic role that a donor acknowledgment letter plays in donor retention can significantly elevate your organization’s fundraising efforts.

This letter overcomes challenges like email blindness and mail clutter (that leads people to ignore letters without even opening them) because it is as important for donors as it is for you.

Don’t you think this presents an amazing opportunity to engage with them better?

Not just that, getting creative with your donor acknowledgment letters would also help you stand out which would ultimately build loyalty and boost donor retention.

Since the IRS does not have a specific template for acknowledgment letters (it only specifies including the aforementioned elements), you can get as creative with your letters as you want.

Related Reading: Donor Recognition: Best Practices to Nurture Donor Relationship

When should you send acknowledgment letters?

For the letter to be considered valid, the donor must receive it either on the date they decide to file their individual tax return or before the due date of filing returns for everyone.

Generally, all nonprofit organizations send these letters by 31 January of the year following the fiscal year in consideration. Timely sending of the donor acknowledgment letter is not just a legal obligation but a crucial step in fostering ongoing donor engagement.

However, a typical turnaround time that all nonprofits aim for is 48 hours after receiving the donation. If that seems like a stretch, aim to send the acknowledgment at least within a week.

Donor acknowledgment letters are like pancakes, serve them right away while they’re hot!

Donor acknowledgment letter tips to revamp and maximize their impact

Before we dive into tips to make your donor acknowledgment letter serve a purpose beyond that of a legal document, let’s take a look at some crucial elements it should have. Optimizing the content and structure of your donation acknowledgment letter can have a lasting impact on donor satisfaction and future contributions.

How to write a basic donor acknowledgment letter?

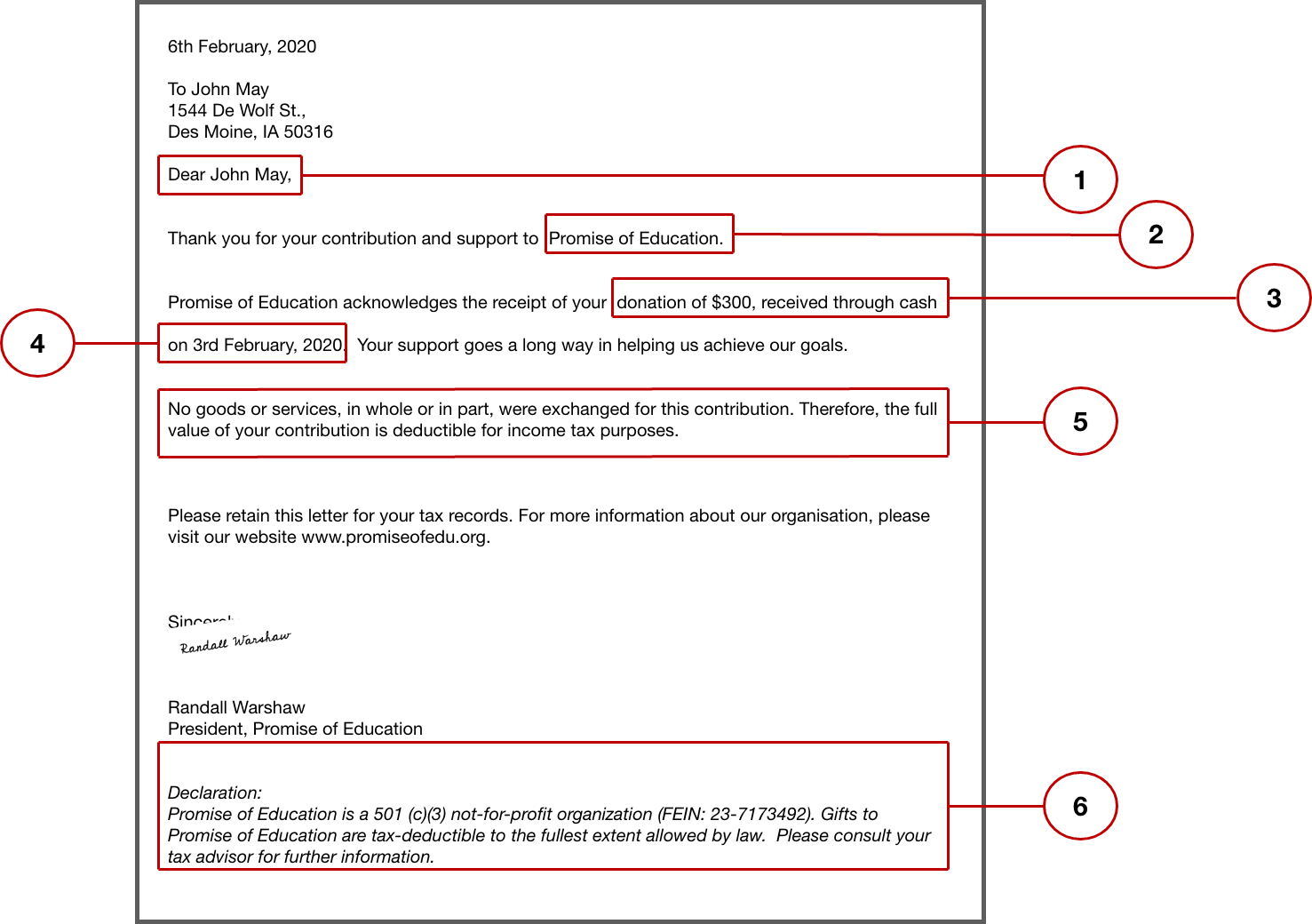

Let’s follow the example of the acknowledgment letter given above. Here are the components that each acknowledgment letter must have:

1. Donor’s Name

Address the donor by their full name so that they can claim tax deductions under it.

2. Organization’s Name

You might print the letter on your official letterhead which may have the name and logo of your organization. However, you still have to include the official name of your organization within the letter.

3. Contribution Details

Was the donation made in cash, through a cheque or a credit card, or was it a payroll deduction? You’ll have to make it clear how the donation was received.

For donors giving non-cash gifts (like supplies, services, etc.), you will have to include a description of what they were. Giving the value of the gift is not necessary.

4. Date of contribution:

The date on which the donation was received. This date is important for the donor and the IRS to accurately map which year the tax deduction can be claimed.

5. Estimated Value of Goods or Services

Each letter will have to detail the value of any goods or services provided to the donor in exchange for the gift.

In case no exchange was made, add a statement that says so.

In cases where an exchange was made, mention a description and good faith estimate of the value of those goods or services.

For example, an estimated value of dinner provided to the donor for their charitable organization towards the fundraising event.

Make a note of the goods or services provided to the donor even if they were insubstantial like bumper stickers or badges.

In case the exchange was of intangible benefits (like religious benefits), you will have to mention that too.

6. Declaration of Tax-exempt status

The nonprofit has to declare that it is a 501c3 tax-exempt organization. The Employer Identification Number (EIN) also has to be included for the IRS to cross-check.

For more detailed insights, you can refer to the IRS Publication 1771.

As mentioned before, the IRS does not define a specific format of donor acknowledgment letters. It only requires you to include the aforementioned information.

This gives us the opportunity to revamp the letter into something more engaging.

Let’s take a look at another example of a donor acknowledgment letter.

While this acknowledgment letter includes all the relevant information required by the IRS, it makes it a little more interesting and more engaging with some extra elements.

You May Also Like: Ending The Year With A Smile: How To Write The Perfect Year-end Thank You Letter

Best Practices

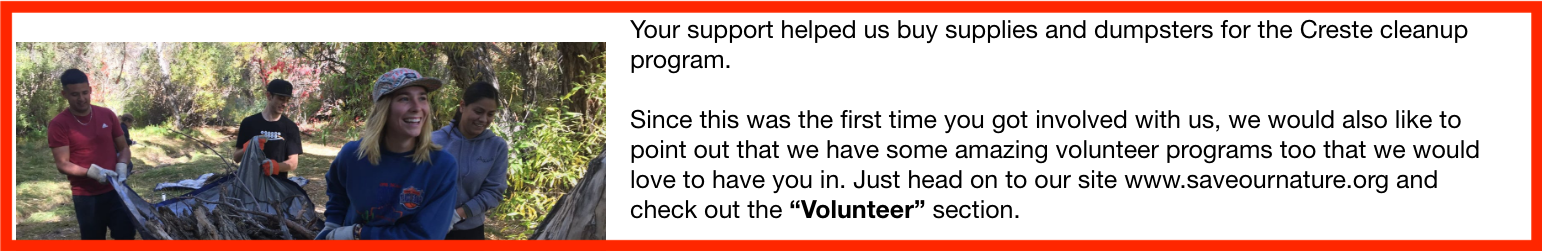

Include images

A picture is worth a thousand words.

Since you can’t really write a thousand words in your letter (no matter how much you want to), add images to highlight your story. Including compelling visuals in your donation acknowledgment letter captures attention and reinforces the emotional connection between donors and your cause.

Images in your letters have the following benefits:

- They grab the reader’s attention and keep them engaged. Images are always more appealing and break the monotony of text by adding a little color.

- They give you an opportunity to depict a story. If you notice in the letter above, the images are not random. They show the state of the meadows before, the action taken by the organization, and the final results.

Telling a story is always more effective in appealing to donor sentiment and winning their loyalty.

- They make your letter unique. A unique letter not only entices a reader but also helps them retain crucial information about the letter (like the organization’s name or work).

What do you think a donor will recall more clearly, one among ten letters filled with text or the one letter with images?

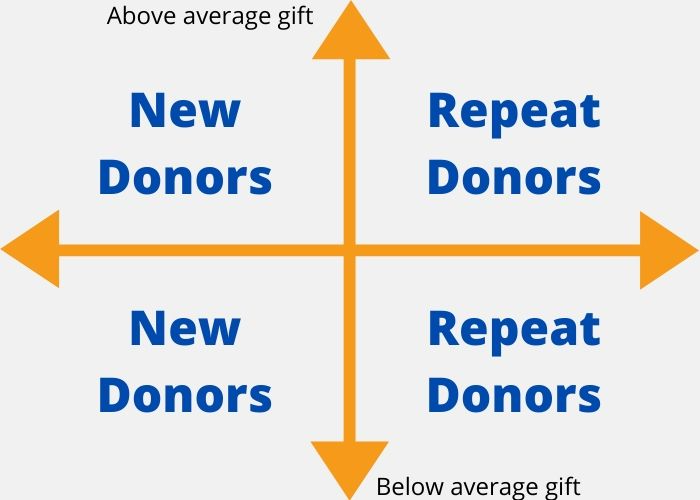

Personalization via segmentation

Did you notice how the letter states that this is the donor’s first time getting involved with the nonprofit?

Implementing donor segmentation allows for a more targeted and personalized donor acknowledgment letter, acknowledging their unique relationship with your organization.

Personalizing your letters can improve your retention and impact significantly. In fact, studies suggest that personalization can boost your retention rate by 39%.

But, personalization is not just about using the donor’s name and donation amount, it goes way beyond that. Personalization is about making the message more relevant to the donor.

You may ask, how could you bring in this level of personalization in your letters?

The answer is quite simple, donor segmentation.

Every donor has a different relationship with your organization, and you have to leverage this relationship to personalize your messaging.

You can segment donors based on their giving behavior, demographics, interests, etc. to craft your message.

For instance, in the donor acknowledgment letter example above, the letter starts with a story that only locals of Creste Meadows can relate to. But the same story (messaging) won’t work with donors living in other states, it won’t be of any relevance to them.

By leveraging personalization in your messaging, you make the donor feel more valued rather than a cash cow. The more important your donors feel, the more likely they are to return to you.

While segmentation can be achieved using any pattern, the most popular method is segmenting them based on their giving behavior as shown below.

The objective of this segmentation is to create messaging that helps you retain these donors and motivates them to give again.

You can personalize the messaging for each segment based on the following characteristics.

New donors giving less than your average gift amount

There are two reasons new donors might give you a small donation instead of a generous donation. Since you can’t be sure which of these is the reason, it would be safe to cover both.

Here is why donors give a small donation – that is a lot less than your average gift size

1. Their financial capability is limited

If this is the case, you can use your donor acknowledgment letters to include other ways the donor can contribute (like volunteering, peer-to-peer fundraising, matching gifts, etc.,).

2. They might be prospective recurring/major donors testing new waters (to understand your impact)

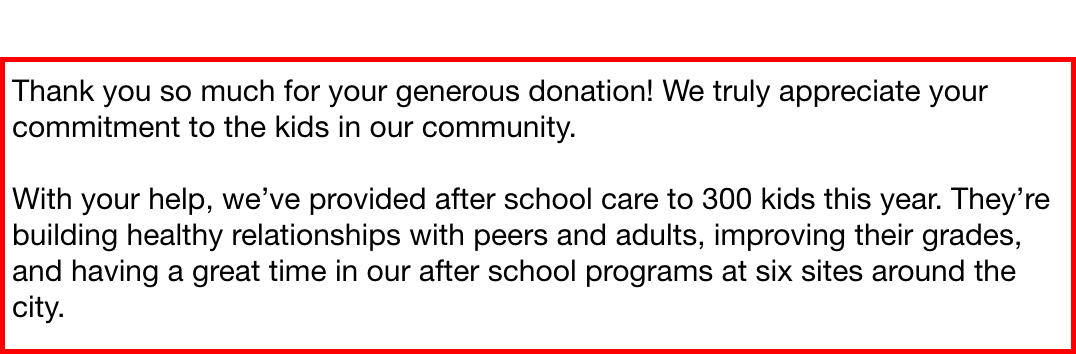

To address the prospective major/recurring donors, mention the kind of impact your work had (either in the past or with this current program they donated to).

Although the messaging in the letter above is not as detailed, here’s an excerpt from another letter to give you an idea of what your messaging must include:

You can ensure that future messaging to these donors is relevant by tracking the subsequent actions they take after receiving the letter.

For instance, in case a donor volunteers after getting the letter, you know the reason they gave less and can hence make note of that in your donor management platform.

- New donors giving more than your average gift amount

New major or mid-level donors would have put in a lot of thought before making the donation.

Therefore, make sure to appreciate donors for their time and consideration in your message. You should also mention exactly how their donation would be used by you.

If you send major and mid-level donors welcome packages, mention their names somewhere, or call them to thank them, add this to your letter too.

Remember, the idea of the donor acknowledgment letters for them is to ensure that they give again. They are clearly invested in your cause.

But they will only return if they see tangible merit in their donation. That is why it is important to tell them how their money will be used.

- Repeat donors giving less than your average gift amount

Never take your repeat donors for granted. This is the only way you lose them.

Your repeat donors are special and have a higher lifetime value than those who give only once. Through regular donations, most of the time their total donation surpasses single donations (even of above-average gift sizes) over a period of time.

Repeat donors giving small donations are typically those with limited financial capabilities who are very passionate about your work.

Your letters to them must highlight that you are aware of their regular support and how special they are for your cause.

You could also talk to them about a monthly giving program that would reduce their financial burden and make it easier for them to donate.

Apart from that, inviting them for a personal tour or special event, giving them a special mention somewhere is also something you can include in the letter.

- Repeat donors giving more than your average gift amount

Repeat donors who give more than your average gift amount are probably the source of a majority of your funds.

Highlight this fact in your acknowledgment letters to them and make sure they know how much you’ll be set back if they ever leave you.

Similar to other repeat donors, you can send them invites to special events or tours too.

Including a brief about the nonprofit fundraising campaigns you’ll be having (immediately or later) and inviting them for the same is also good practice (you could either send them an invitation along or ask them to request one online if they wish to come).

Provide Measurable Impact

While you can inform donors about how their money is being used through emails or other means, it’s very easy for this vital information to get lost in the crowd. Your donor acknowledgment letter is a way to reinforce this information.

Highlighting the measurable impact of their contributions in your donor acknowledgment letter builds trust and encourages continued support.

Apart from assuring them that their money was used well, providing a measurable impact that their donation had you subtly build your credibility.

This trust, in turn, inspires them to come back to you whenever they wish to make a donation.

An alternative way to showcase the impact of their donations would be with a personal story like in the example below:

Tells a story (that donors can relate to)

Your donor acknowledgment letter doesn’t have to be a boring legal document. You can craft it to engage your donors better with a creative storytelling approach. Weaving a compelling narrative into your donation acknowledgment letter transforms them into powerful tools for donor engagement, making your organization more memorable.

“Please help Sheeba and donate for her education”

OR

“Sheeba is a small girl with big dreams. But she needs to go to school to achieve those dreams. Unfortunately, life took a toll on her and her parents passed away leaving a huge gap between her and her dreams. Would you help fill that gap?”

Which of these appeals do you think would draw more donors? Quite obviously the second one.

Stories make your work more human and most of all, more relatable to the public. They give you the opportunity to connect with donors emotionally and further inspire them to unite in action.

Your stories also connect donors to beneficiaries benefitting from their contribution which presses the need for your work and their continued support.

Initially, we spoke about telling a story through your images. But you don’t have to limit it to that. You can tell a story with more than just images (or even reflect the story in the images) in the letter body.

In the example above, Save Our Nature leverages a similar storytelling approach with a personal experience to establish that emotional connection.

They also showcase the beneficiaries uniquely which adds to their motivation for future giving.

Takeaway

Treat donor acknowledgment letters not just as a formal way to thank them, but to engage with them, retain them, and build a relationship.

Optimizing the content and personalization of your donation acknowledgment letter can significantly impact donor retention and loyalty, ultimately fostering a stronger connection between donors and your organization.

So don’t just look into conveying the information required by the IRS through this letter. Aim to make this touchpoint more effective by segmenting the list, crafting the right messaging for each, telling a story, etc.

The donor acknowledgment letter is your most powerful touchpoint as the likelihood of people reading it completely is high. This is why it has the power to make a lasting impact on donor retention and loyalty. Make sure to use it wisely.